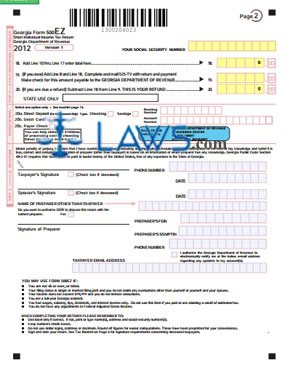

Form 500-EZ Short Individual Income Tax

INSTRUCTIONS: GEORGIA SHORT INDIVIDUAL INCOME TAX RETURN (Form 500EZ)

Full-year Georgia residents whose income is not over $99,999, who do not itemize deductions, who are not blind or 65 or older, who are filing as a single individual or married filing jointly and do not claim any exemptions other than themselves and their spouse, who do not have adjustments to their federal adjusted gross income, who only derived income from wages, salaries, tips, dividends and interest income and who are not claiming or being paid a credit for estimated tax payment can file their state tax due using a form 500EZ. This document is found on the website of the Georgia Department of Revenue.

Georgia Short Individual Income Tax Return 500EZ Step 1: At the top right-hand corner, enter your Social Security number and that of your spouse if filing jointly.

Georgia Short Individual Income Tax Return 500EZ Step 2: Enter your first name, middle initial, last name and suffix if applicable, as well as that of your spouse if applicable.

Georgia Short Individual Income Tax Return 500EZ Step 3: Enter your full address.

Georgia Short Individual Income Tax Return 500EZ Step 4: Enter your federal adjusted gross income on line 1.

Georgia Short Individual Income Tax Return 500EZ Step 5: If single, enter $5,000 on line 2. If filing jointly, enter $8,400 here.

Georgia Short Individual Income Tax Return 500EZ Step 6: Subtract line 2 from line 1 and enter the difference on line 3. If this results in a negative number, enter zero.

Georgia Short Individual Income Tax Return 500EZ Step 7: Consult the tax table in the separate instruction booklet to determine your tax and enter this on line 4.

Georgia Short Individual Income Tax Return 500EZ Step 8: If you are not claimed as a dependant on another form and are eligible for a low income tax credit, enter this on line 5.

Georgia Short Individual Income Tax Return 500EZ Step 9: Follow instructions lines 6 through 9 to determine the balance owed or refund due.

Georgia Short Individual Income Tax Return 500EZ Step 10: Voluntary donations to various funds can be noted on lines 10 through 17, totaled on line 18, and applied to your balance due on line 19 or refund owed on line 20. Sign and date the bottom of the form. Provide all required contact information.