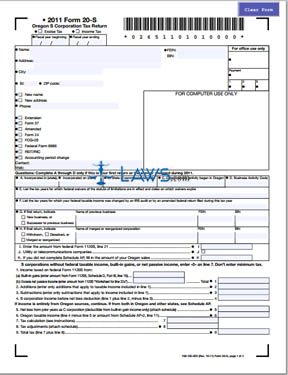

Form 20-S Oregon S Corporation Tax Return

INSTRUCTIONS: OREGON S CORPORATION TAX RETURN (Form 20-S)

Oregon S corporations file their corporate taxes with a form 20-S. This document is found on the website of the government of Oregon.

Oregon S Corporation Tax Return 20-S Step 1: At the top of the first page, give your business name, address and identification number. Indicate with a check mark if filing a form documenting a new business name or address. Enter your phone number. Indicate with a check mark what type of form you are filing and give a contact person's name and web address.

Oregon S Corporation Tax Return 20-S Step 2: Questions A through D are only for first-time filers or those whose answers to these questions changed during the past year.

Oregon S Corporation Tax Return 20-S Step 3: In line E, list years for which federal waivers on the statute of limitations apply and give their expiration dates. If you were audited or filed an amended federal return, give the applicable tax years on line F.

Oregon S Corporation Tax Return 20-S Step 4: Line G is for those who are filing a first return. Indicate if this is a new return or if you are filing for a successor to a previous business. If the latter, give the previous business' name and identification number. Line H is for those filing a final return. On line I, enter the number from line 21 on your federal form 1120S. Line J is only for utility and telecommunications companies. Those who are not required to complete a schedule AP should enter their total Oregon sales on line K.

Oregon S Corporation Tax Return 20-S Step 5: Follow instructions on lines 1 through 9 to compute your total tax owed.

Oregon S Corporation Tax Return 20-S Step 6: Lines 10 through 24 on the second page concern the computation of your adjusted taxes owed or refund due.

Oregon S Corporation Tax Return 20-S Step 7: Schedule SM is only for corporations documenting modifications passed through to shareholders.

Oregon S Corporation Tax Return 20-S Step 8: If you have made estimated tax payments or prepayments in advance, complete Schedule ES.

Oregon S Corporation Tax Return 20-S Step 9: A corporation officer should sign and print their name, provide their title and enter the date.