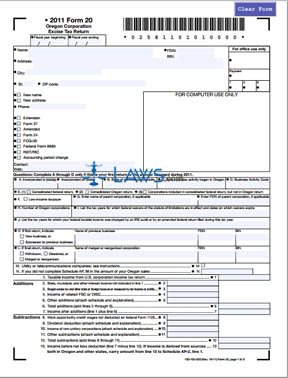

Form 20 Oregon Corporation Excise Tax Return

INSTRUCTIONS: OREGON CORPORATION EXCISE TAX RETURNS (Form 20)

Oregon corporations file their excise tax owed by using a form 20. This document is found on the website of the state of Oregon.

Oregon Corporation Excise Tax Returns 20 Step 1: Enter the starting and ending dates of your fiscal year if not filing on a calendar year basis.

Oregon Corporation Excise Tax Returns 20 Step 2: Give your business name, address and phone number where indicated. If filing with a new name or address, indicate this with a check mark.

Oregon Corporation Excise Tax Returns 20 Step 3: Indicate the type of attachments you have included, if any, with a check mark.

Oregon Corporation Excise Tax Returns 20 Step 4: Questions A through D are only for first-time filers or those reporting changed answers from the previous year.

Oregon Corporation Excise Tax Returns 20 Step 5: Line E asks you to indicate if you were documented on a consolidated federal or state return, or if you were included in a consolidated federal return but not a consolidated Oregon return.

Oregon Corporation Excise Tax Returns 20 Step 6: Low income taxpayers should check the box in box F. If you are filing as part of a parent corporation, enter its name and identification number on line G.

Oregon Corporation Excise Tax Returns 20 Step 7: Enter the number of Oregon corporations belonging to your business in box H. Lines I and J concern federal waivers and years in which you were audited or filed an amended federal return.

Oregon Corporation Excise Tax Returns 20 Step 8: Line K concerns those filing an initial return only, while line L is only for those filing a final return. Line M is only for utility and telecommunications companies. Line N is only for those who did not complete a schedule AP.

Oregon Corporation Excise Tax Returns 20 Step 9: Lines 1 through 7 contain instructions for computing your total income.

Oregon Corporation Excise Tax Returns 20 Step 10: Lines 8 through 18 concern subtractions from income.

Oregon Corporation Excise Tax Returns 20 Step 11: Lines 19 through 28 provide instructions for calculating your total credits.

Oregon Corporation Excise Tax Returns 20 Step 12: Calculate your excise tax owed as instructed on lines 29 through 43. Document any estimated tax payments already made in the box provided in Schedule ES.