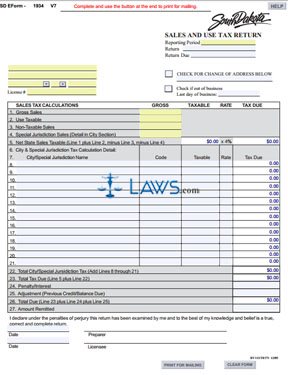

Form 1934 Sales and Use Tax Return

INSTRUCTIONS: SOUTH DAKOTA SALES AND USE TAX RETURN (Form 1934)

Every South Dakota business is required to file a sales and use tax return for every reporting period even if no tax is owed. This form 1934 can be obtained from the website of the state of South Dakota.

South Dakota Sales And Use Tax Return 1934 Step 1: On the left side of the page, enter your business name and address. Check the applicable box if filing a return from a new address. If filing for a business which has ceased operations, check the applicable box and enter the date on which operations cased.

South Dakota Sales And Use Tax Return 1934 Step 2: At the top right-hand corner, enter the reporting period in question, the return filing number and the return due date.

South Dakota Sales And Use Tax Return 1934 Step 3: Enter your gross sales on line 1, your total sales subject to use tax on line 2, your total sales exempt from tax on line 3 and all special jurisdiction sales on line 4.

South Dakota Sales And Use Tax Return 1934 Step 4: Subtract line 3 from the sum of lines 1 and 2, then subtract line 4 from this difference. Multiply the difference by 4% to determine your total tax owed and enter the product on line 5.

South Dakota Sales And Use Tax Return 1934 Step 5: On lines 8 through 21, document all sales made in special jurisdictions. Enter the name of the city or special jurisdiction in the first column, its code in the second column, the taxable total of the sales in the third column, and the applicable tax rate in the fourth column. Multiply the third and fourth columns and enter the product in the fifth column.

South Dakota Sales And Use Tax Return 1934 Step 6: Enter the total from the fifth column on line 22.

South Dakota Sales And Use Tax Return 1934 Step 7: Add lines 5 and 21. Enter the sum on line 23.

South Dakota Sales And Use Tax Return 1934 Step 8: If filing late, calculate your penalty and interest on line 24 as instructed on the second page. If you have a previous balance due, enter it on line 25. Enter the sum of lines 23 through 25 on line 26. Sign and date the form.