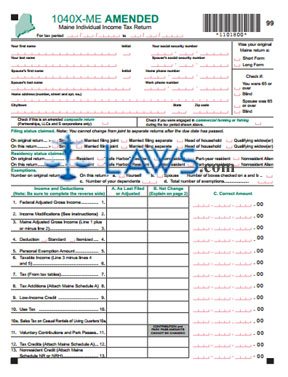

Form 1040X-ME Maine Amended Individual Income Tax Return

INSTRUCTIONS: AMENDED MAINE INDIVIDUAL INCOME TAX RETURN (Form 1040X-ME)

Residents, part-year residents and non residents who need to amend a previously filed Maine individual income tax return do so using a form 1040X-ME. This document is found on the website of the government of Maine.

Amended Maine Individual Income Tax Return 1040X-ME Step 1: At the top of the page, enter the beginning and ending dates of the tax period you are filing to amend.

Amended Maine Individual Income Tax Return 1040X-ME Step 2: Give your name and Social Security number, as well as that of your spouse if you have filed jointly. Enter your home and work phone numbers.

Amended Maine Individual Income Tax Return 1040X-ME Step 3: Enter your home street address, city, state and zip code.

Amended Maine Individual Income Tax Return 1040X-ME Step 4: Indicate with a check mark whether you initially filed a short form or long form return.

Amended Maine Individual Income Tax Return 1040X-ME Step 5: Check the applicable lines if you or your spouse were blind or 65 or older during this applicable tax period.

Amended Maine Individual Income Tax Return 1040X-ME Step 6: Check the box next to the filing and residency status claimed, both originally and on this amended return.

Amended Maine Individual Income Tax Return 1040X-ME Step 7: Indicate the number of exemptions being claimed.

Amended Maine Individual Income Tax Return 1040X-ME Step 8: On lines 1 through 24, you must fill in 3 columns. Column A requires you to enter your last filed or amended figures. Column B requires you to enter the net change between your original and newly corrected figures. Column C is for the correct amounts.

Amended Maine Individual Income Tax Return 1040X-ME Step 9: Follow instructions on lines 1 through 24 to determine the total amount you owe or the size of the refund you are entitled to.

Amended Maine Individual Income Tax Return 1040X-ME Step 10: Those who are entitled to a refund may wish to receive it as a direct deposit. If so, give your routing and account number and indicate if this is a checking or savings account where indicated.

Amended Maine Individual Income Tax Return 1040X-ME Step 11: Provide a written explanation of all reported changes, and include line numbers for each change. Sign and date the form and give your occupation.