Form E1350V8 Use Tax Form

INSTRUCTIONS: SOUTH DAKOTA USE TAX FORM (Form 1350 V8)

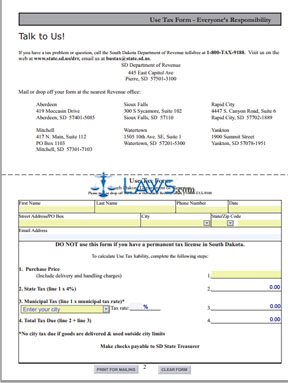

South Dakota residents must file a use tax form if they purchased a product from out of state on which they paid no income tax to the state, or if they paid sales tax for another state which was less than what would be paid within the state. You are not required to file this form if you have a permanent tax license in South Dakota. The form can be found on the website of the South Dakota Department of Revenue or obtained by calling their phone number to request a copy.

South Dakota Use Tax Form 1350 V8 Step 1: The form is on the second page of this document. Detach it by cutting along the dotted line.

South Dakota Use Tax Form 1350 V8 Step 2: On the first line of the table, enter your first name, last name, your phone number, and the date on which you are filing.

South Dakota Use Tax Form 1350 V8 Step 3: On the second line of the table, give your street address or PO box number, your city and zip code.

South Dakota Use Tax Form 1350 V8 Step 4: On the third line of the table, enter your email address.

South Dakota Use Tax Form 1350 V8 Step 5: On line one, enter the purchase price of the item in question, including the delivery and handling charges.

South Dakota Use Tax Form 1350 V8 Step 6: On line two, calculate the state tax owed by multiplying this price by four percent.

South Dakota Use Tax Form 1350 V8 Step 7: On line three, calculate the municipal tax owed. The municipal tax rate for every part of the state can be found on the website of the Business Tax Division of the South Dakota Department of Revenue. These rates may be updated twice a year, in January and July. Multiply your purchase price by the municipal tax rate. If your item is used outside city limits, you do not owe this tax.

South Dakota Use Tax Form 1350 V8 Step 8: Add lines two and three. Enter the total on line four to determine your total tax due.

South Dakota Use Tax Form 1350 V8 Step 9: Submit the form in person or via mail along with a check to the closest Revenue office of those listed in the instructions.