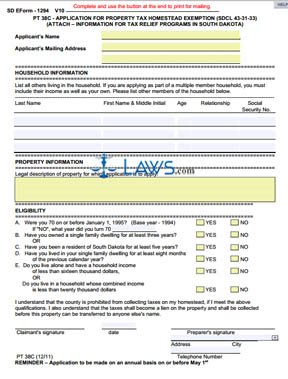

Form PT-38C Application for Property Tax Homestead Exemption

INSTRUCTIONS: SOUTH DAKOTA APPLICATION FOR PROPERTY TAX HOMESTEAD EXEMPTION (Form PT 38C)

South Dakota residents who are at least 70 years old or a surviving spouse, who have lived in the state for at least five years or owned a single-family household for the past three years, have lived there for at least eight months of the past year and who earn no more than $16,000 a year in a single-member household or $20,000 a year in a multiple-person household can apply for a property tax exemption on their primary place of residence. This article discusses the form 38C which can be filed in such cases. The form can be found on the section of the official website of South Dakota maintained by the Department of Revenue and Regulation.

South Dakota Application For Property Tax Homestead Exemption PT 38C Step 1: At the top of the page, enter your name and complete mailing address.

South Dakota Application For Property Tax Homestead Exemption PT 38C Step 2: Under "Household Members," give the last name, first name and middle initial, age, relationship to you and Social Security number of every person living at the property in question.

South Dakota Application For Property Tax Homestead Exemption PT 38C Step 3: Under "Property Information," give a legal description of the homestead in question.

South Dakota Application For Property Tax Homestead Exemption PT 38C Step 4: The next section concerns your eligibility. Question A asks whether you were 70 years old on or before January 1, 1995. If no, give the year in which you turned 70.

South Dakota Application For Property Tax Homestead Exemption PT 38C Step 5: Question B asks if you have owned a single family dwelling for at least three years. Question C asks if you have been a South Dakota resident for at least five years. You must answer "Yes" to one of these questions.

South Dakota Application For Property Tax Homestead Exemption PT 38C Step 6: Question D asks if you have lived in the homestead for at least eight months of the previous year.

South Dakota Application For Property Tax Homestead Exemption PT 38C Step 7: Question E asks about the income eligibility requirements of your household. Answer "yes" or "no" as appropriate.

South Dakota Application For Property Tax Homestead Exemption PT 38C Step 8: Sign and date the form.