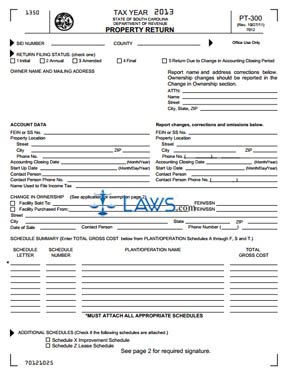

Form PT-300 Property Return

INSTRUCTIONS: SOUTH CAROLINA PROPERTY RETURN (Form PT-300)

South Carolina businesses must file an annual property return document with the state's department of revenue. This document PT-300 can be found on their website.

South Carolina Property Return PT-300 Step 1: At the top of the page, enter your company's SID number and county.

South Carolina Property Return PT-300 Step 2: Under "Return Filing Status," indicate with a check mark whether this is your initial, first filing in the state, an annual return, an amended return, the final return of a company which is dissolving or a return documenting a change in your accounting closing period.

South Carolina Property Return PT-300 Step 3: Write the owner name and address where indicated.

South Carolina Property Return PT-300 Step 4: Write any name or address changes where indicated.

South Carolina Property Return PT-300 Step 5: Under "Account Information," give your Federal Employer Identification Number (FEIN) or Social Security number, the full street address of the property in location, the starting and closing date of your accounting system, the name and telephone number of a contact person, and the name used when filing income tax returns.

South Carolina Property Return PT-300 Step 6: The section on the right is labeled "Report changes, corrections and omissions below." This requests the same information as reported in step 5 but is only to be completed if you are reporting changes since your last annual filing.

South Carolina Property Return PT-300 Step 7: The next section is labeled "Change In Ownership." If you sold a facility, write the name of the purchaser and their tax ID number. If you purchased a facility, give the name of the seller and the full address of the facility in question.

South Carolina Property Return PT-300 Step 8: The next section is labeled "Section Summary." This concerns plants or facilities which you operate and for which you are required to submit Schedules A through F, S and T, all of which are PT-300 forms. Give the schedule letter and number for each plant, the name of the facility, and the total gross cost associated with each facility.

South Carolina Property Return PT-300 Step 9: Indicate with a check mark whether you are including a schedule X (required if you have made property improvements) or schedule Z (required if you are leasing or lease property