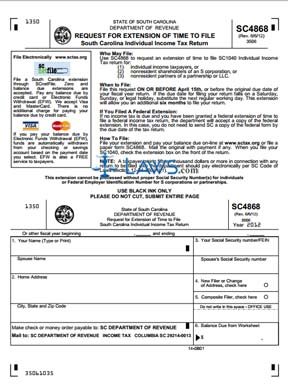

Form SC4868 Request for Extension of Time to File

INSTRUCTIONS: SOUTH CAROLINA REQUEST FOR EXTENSION OF TIME TO FILE SOUTH CAROLINA INDIVIDUAL INCOME TAX RETURN (Form SC4868)

To request an extension of time to file your South Carolina individual income tax return, you can file the form discussed in this article. This document can be obtained from the website maintained by the South Carolina Department of Revenue.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 2: In box 1, enter your name, as well as that of your spouse if applicable.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 3: In box 2, enter your home address, city, state and zip code.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 4: In box 3, enter your Social Security number or federal employer identification number, as well as your spouse's Social Security number if applicable.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 5: If you are a new filer or documenting a new address, check box 4.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 6: If you are a composite filer, check box 5.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 7: Skip to the worksheet on the second page. Enter your total state income tax due on line A.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 8: Enter your total use tax owed on line B.

South Carolina Request For Extension Of Time To File South Carolina Individual Income Tax Return SC4868 Step 9: Enter the sum of lines A and B on line C. Document and total your credits on lines D through G. Subtract line G from line C and enter the difference on line H and in box 6 on the first page. This figure is your balance owed. Submit payment along with this form.