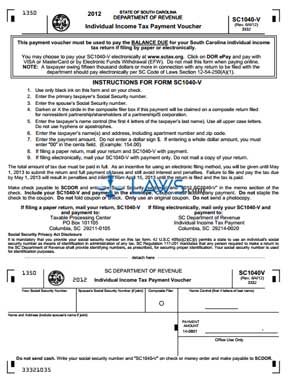

Form SC1040-V Individual Income Tax Payment Voucher

INSTRUCTIONS: SOUTH CAROLINA INDIVIDUAL INCOME TAX PAYMENT VOUCHER (Form SC1040-V)

South Carolina taxpayers who file their state individual income tax return by paper or electronically are required to complete form SC1040-V to pay their balance due. This document can be obtained from the website maintained by the South Carolina Department of Revenue.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 1: In the first blank box, enter your Social Security number.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 2: If filing a joint tax return, enter your spouse's Social Security number in the second blank box.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 3: Darken the circle or place an X in the circle in the third blank box if this payment will be claimed on a composite return filed for nonresident partnerships or shareholders in a partnership or S corporation.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 4: Enter the first four letters of your last name in the fourth blank box in all capital letters. Do not include hyphens or apostrophes.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 5: In the fifth blank box, enter your name, street address, city, state and zip code.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 6: In the sixth blank box, enter the amount. Do not include the dollar sign.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 7: Detach the voucher from the instructional portion of the page along the dotted line.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 8: Regardless of whether you are filing your return by paper or electronically, if you are not submitting payment electronically your check must be made payable to "SCDOR." In the memo section of the check, include your Social Security number, the tax year you are filing for, and "SC1040-V." Do not staple the check to the voucher.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 9: If you are filing a paper return, mail the return, this form and your payment to the address given at the bottom left hand corner.

South Carolina Individual Income Tax Payment Voucher SC1040-V Step 10: If you are filing an electronic return, mail this form and your payment to the address given at the bottom right hand corner.