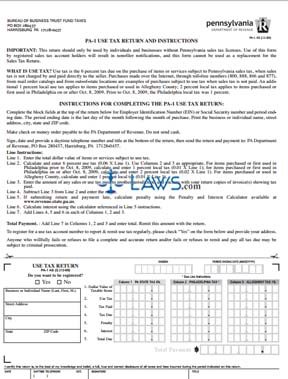

Form PA-1 Use Tax Return

INSTRUCTIONS: PENNSYLVANIA USE TAX RETURN (Form PA-1)

Pennsylvania residents and businesses which do not have a sales tax license must file a use tax return must complete a use tax return whenever a purchase is made from an out-of-state retailer on which no state sales tax is found. The form can be found on the website of Pennsylvania's Enterprise Portal.

Pennsylvania Use Tax Return PA-1 Step 1: Detach the return from the top half of the page along the dotted line.

Pennsylvania Use Tax Return PA-1 Step 2: At the top of the form, enter your Employer Identification Number or Social Security number.

Pennsylvania Use Tax Return PA-1 Step 3: In the box on the left, enter the name of the business or individual filing and their full street address.

Pennsylvania Use Tax Return PA-1 Step 4: If you wish to register for a use tax account number if you expect to pay this tax regularly, check "yes" next to the statement above. Otherwise, check "no."

Pennsylvania Use Tax Return PA-1 Step 5: On line 1, enter the total dollar value of all taxable items under column 1.

Pennsylvania Use Tax Return PA-1 Step 6: On line 2, calculate the state tax owed. Under column 1, multiply the total of the purchase by the state rate of 6% and enter the result. If purchased or used in Philadelphia before October 8, 2009, multiply this total by 1% under column 2. If purchased or used in Philadelphia on or after this date, multiply this total by 2%. If purchased or used in Alleghany County, multiply this total by 1% and enter the result under column 3.

Pennsylvania Use Tax Return PA-1 Step 7: On line 3, enter any state or use tax paid to another jurisdiction. You must attach copies of any invoices documenting these payments.

Pennsylvania Use Tax Return PA-1 Step 8: Subtract line 3 from line 2 and enter the sum on line 4.

Pennsylvania Use Tax Return PA-1 Step 9: If you are submitting your return and payment late, you must calculate your penalty and interest due as instructed on lines 5 and 6 respectively.

Pennsylvania Use Tax Return PA-1 Step 10: Add lines 4 through 6 in all columns and enter the total on line 7. Column the totals from all 3 columns and enter the total amount where indicated. Sign and date the form.