Form Industrial Property Return

INSTRUCTIONS: OREGON INDUSTRIAL PROPERTY RETURN (Form 150-301-032)

Every Oregon industrial business must annually file a form 150-301-032 documenting the property associated with their company. This form can be found on the section of the state of Oregon's website operated by the Department of Revenue.

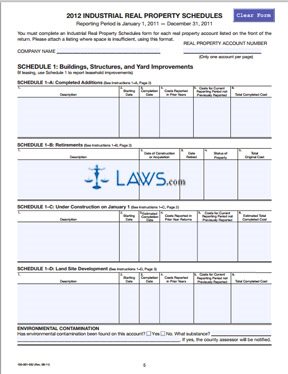

Oregon Industrial Industrial Property Return 150-301-023 Step 1: The first four pages consist of instructions. At the top of the fifth page, enter the name of your company and the real property account number. If you have more than one real account number, attach additional forms as necessary. Only one real account number can be entered per page.

Oregon Industrial Industrial Property Return 150-301-023 Step 2: Schedule 1 concerns real property. Under section 1A, list all completed structure additions to your property, including a description, the starting and ending dates of construction, any costs associated in previous years with this work, costs not previously reported, and the total cost.

Oregon Industrial Industrial Property Return 150-301-023 Step 3: Section 1b asks for information about all buildings retired from use. Section 1c asks for information about all structures currently under construction. Section 1d asks for information about all completed land site development. Note any environmental contamination at the bottom of the page.

Oregon Industrial Industrial Property Return 150-301-023 Step 4: Schedule 2 concerns machinery and equipment. Section 2a asks for information about all machinery and equipment which has been acquired. Section 2b asks for information about machinery and equipment which has been retired. Section 2c concerns equipment which has been acquired but not yet been completely installed. Section 2d1 concerns equipment which is leased. Section 2d2 concerns leased equipment which has been retired from use.

Oregon Industrial Industrial Property Return 150-301-023 Step 5: Section 3 requires you to detail your production output, changes in design or output, work schedule, and the unit by which you measure productivity.

Oregon Industrial Industrial Property Return 150-301-023 Step 6: Section 4 concerns personal property, non-inventory supplies and personal property owned by others which is in your possession.

Oregon Industrial Industrial Property Return 150-301-023 Step 7: Section 5 should only be completed if any of your buildings, machinery or personal property qualify for an enterprise zone exemption.

Oregon Industrial Industrial Property Return 150-301-023 Step 8: When filing this form, include a cover sheet with your company's name, address and account numbers