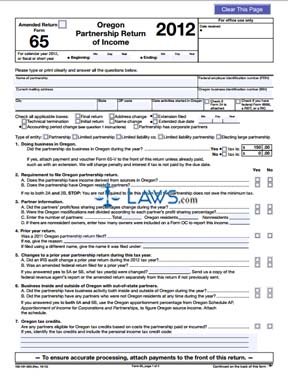

Form 65 Oregon Partnership Return of Income

INSTRUCTIONS: OREGON PARTNERSHIP RETURN OF INCOME (Form 65)

Partnerships operating in Oregon use a form 65 to document their income. This document can be obtained from the website maintained by the Oregon Department of Revenue.

Oregon Partnership Return Of Income 65 Step 1: If filing an amended return, check the box at the top of the first page.

Oregon Partnership Return Of Income 65 Step 2: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal or short year.

Oregon Partnership Return Of Income 65 Step 3: On the first line, enter the name of the partnership and its federal employer identification number.

Oregon Partnership Return Of Income 65 Step 4: On the second line, enter your current mailing address and Oregon business identification number.

Oregon Partnership Return Of Income 65 Step 5: On the third line, enter your city, state, zip code and the date on which you began activities in Oregon.

Oregon Partnership Return Of Income 65 Step 6: Check the box where indicated if form 24 is attached.

Oregon Partnership Return Of Income 65 Step 7: Check the box where indicated if forms 8886, REIT or RIC are attached.

Oregon Partnership Return Of Income 65 Step 8: Check all applicable boxes below concerning the type of return being returned.

Oregon Partnership Return Of Income 65 Step 9: Indicate the type of entity filing with a check mark.

Oregon Partnership Return Of Income 65 Step 10: Answer questions 1 through 7 on the first page by checking "Yes" or "No" as directed. Note that if you answer questions 2A and 2B no, you are not required to complete and file this form.

Oregon Partnership Return Of Income 65 Step 11: Answer question 8 with check marks.

Oregon Partnership Return Of Income 65 Step 12: In response to question 9, provide all information requested about the person in possession of partnership books.

Oregon Partnership Return Of Income 65 Step 13: Document additions taxable to Oregon on lines 1 through 7.

Oregon Partnership Return Of Income 65 Step 14: Document subtractions not taxable to Oregon on lines 8 through 13.

Oregon Partnership Return Of Income 65 Step 15: Sign and print your name at the bottom of the second page, as well as providing the date and your complete address.