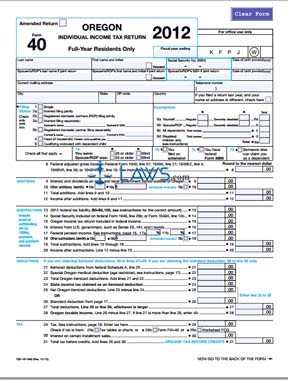

Form 40 Full-Year Resident Long Form

INSTRUCTIONS: OREGON INDIVIDUAL INCOME TAX RETURN FULL-YEAR RESIDENTS LONG FORM (Form 40)

Full-year residents of Oregon can file their individual income tax using a form 40. This long-form return can be obtained from the website of the Oregon Department of Revenue.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 1: If filing an amended return, indicate this with a check mark at the top of the first page.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 2: On the first line, enter your last name, first name and middle initial, Social Security number and date of birth.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 3: On the second line, enter the same information for your spouse if filing jointly.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 4: On the third line, enter your current mailing address and telephone numbe.r

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 5: On the fourth line, enter your city, state, zip code and country. If your name or address was different last year, check the box where indicated.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 6: Indicate your filing status by checking the box next to the appropriate statement on lines 1 through 5.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 7: Document exemptions as directed on lines 6a through 7e.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 8: Enter your federal adjusted gross income rounded to the nearest whole dollar on line 8.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 9: Document additions as directed on lines 9 through 12.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 10: Document subtractions as directed on lines 13 through 20.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 11: If you are claiming itemized deductions, complete lines 21 through 25. If claiming a standard deduction, only complete line 26.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 12: Complete lines 27 through 72 as instructed to calculate your tax owed.

Oregon Individual Income Tax Return Full-Year Residents Long Form 40 Step 13: Sign and date the bottom of the second page.