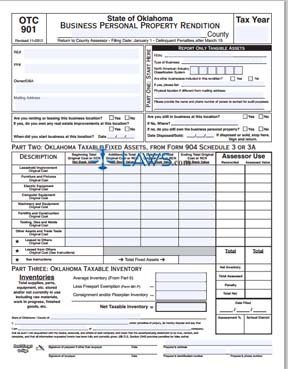

Form OTC-901 Business Personal Property Rendition

INSTRUCTIONS: OKLAHOMA BUSINESS PERSONAL PROPERTY RENDITION (Form OTC-091)

All Oklahoma professionals, partnerships, corporations and businesses must annually file a form OTC-091 documenting their taxable assets. This document can be obtained from the website of the Oklahoma Tax Commission.

Oklahoma Business Personal Property Rendition OTC-091 Step 1: At the top of the page, enter the name of the county you are filing in.

Oklahoma Business Personal Property Rendition OTC-091 Step 2: In the top left box, enter the real estate and personal property account numbers. Give the name of the owner and their mailing address.

Oklahoma Business Personal Property Rendition OTC-091 Step 3: In "Part One," enter your Federal Employer Identification Number (FEIN), the type of business and your North American Industry Classification System number. If other businesses are documented in this document, list them. If the physical location of the business is different from the mailing address, give this address. Give a contact person's name.

Oklahoma Business Personal Property Rendition OTC-091 Step 4: Two boxes below Part One are provided to note if you are renting or leasing the business location and to note if you have you sold or closed the business.

Oklahoma Business Personal Property Rendition OTC-091 Step 5: Part Two requires you to describe and give the value of all taxable fixed assets such as furniture and machinery. These values should be transferred from form 904 schedule 3 or 3A depending on your business

Oklahoma Business Personal Property Rendition OTC-091 Step 6: Part Three concerns your inventory. To complete this section, you will first need to complete Part Six, which require you to give your inventory for every month. You will then need to complete 901-F to determine your freeport exemption. Enter the average inventory and freeport exemption where indicated. This will enable you to determine your net taxable inventory.

Oklahoma Business Personal Property Rendition OTC-091 Step 7: Part Four requires you to detail assets which were added during the reporting year.

Oklahoma Business Personal Property Rendition OTC-091 Step 8: Part Five requires you to detail assets which were sold, broke or otherwise were deleted from use during the reporting year.

Oklahoma Business Personal Property Rendition OTC-091 Step 9: Sign and date the first page. If a paid preparer completed the document, they should sign and date the form as well as providing their address, identification number and phone number.