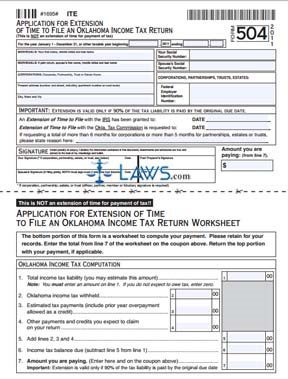

Form 504 Application for Extention of Time to File 2011

INSTRUCTIONS: APPLICATION FOR EXTENSION OF TIME TO FILE AN OKLAHOMA INCOME TAX WORKSHEET (Form 504)

Oklahoma residents who owe additional state income tax or those who have not received a federal filing extension will need to complete an application requesting an extension to file their income tax worksheet. Note that this extension does not apply to payment, which must be submitted with this form 504. Additionally, this extension can only be granted if you have paid at least 90% of the tax due. The document can be found on the website of the Oklahoma Tax Commission.

Application For Extension Of Time To File An Oklahoma Income Tax Worksheet 504 Step 1: Separate the sheet where indicated. The bottom half is a worksheet for your own use that should not be submitted to the Oklahoma Tax Commission. Begin completing this worksheet by entering your total income tax liability on line one. You may estimate if necessary. Enter the Oklahoma tax withheld from wages on line two.

Application For Extension Of Time To File An Oklahoma Income Tax Worksheet 504 Step 2: Enter estimated tax payments you have already made, including credit from previous years, on line three.

Application For Extension Of Time To File An Oklahoma Income Tax Worksheet 504 Step 3: Enter other payments and credits you will be entering on your tax return on line four.

Application For Extension Of Time To File An Oklahoma Income Tax Worksheet 504 Step 4: Add lines two through four on line five. Subtract line five from line one to determine your tax balance due and enter this on line six.

Application For Extension Of Time To File An Oklahoma Income Tax Worksheet 504 Step 5: Enter the amount you will be paying on line seven.

Application For Extension Of Time To File An Oklahoma Income Tax Worksheet 504 Step 6: Complete the top half of this page, the actual application. Give all identifying information requested, including your name and Social Security number.

Application For Extension Of Time To File An Oklahoma Income Tax Worksheet 504 Step 7: Enter the date on which a federal extension was granted, if applicable. Enter the date for how long you would like your extension to last. If greater than five months, explain why. Enter the amount you are paying on the bottom right. Sign and date the form.