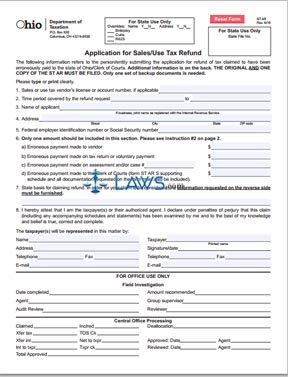

Form Application for Sales and Use Tax Refund

INSTRUCTIONS: OHIO APPLICATION FOR SALES/USE TAX REFUND

Ohio consumers and vendors who have overpaid their sales or use tax and wish to apply for a refund may do so by filing the appropriate application. This document can be found on the website of the state's Department of Taxation.

Ohio Application For Sales/Use Tax Refund Step 1: At the top of the application, indicate with a check mark whether you are a consumer or vendor.

Ohio Application For Sales/Use Tax Refund Step 2: On line 1, enter the sales or use tax license or account number of the vendor.

Ohio Application For Sales/Use Tax Refund Step 3: On line 2, enter the starting and ending dates of the period in question.

Ohio Application For Sales/Use Tax Refund Step 4: On line 3, enter the name of the applicant. If this form is being completed by a business, the name provided must be the one registered with the Internal Revenue Service.

Ohio Application For Sales/Use Tax Refund Step 5: On line 4, enter your complete mailing address.

Ohio Application For Sales/Use Tax Refund Step 6: On line 5a, enter your Federal Employer Identification Number if one has been assigned. Enter your Social Security number on line 5b.

Ohio Application For Sales/Use Tax Refund Step 7: Section 6 concerns your reason for requesting this refund and the size being claimed. Complete line 6a if seeking a refund for an erroneous payment made to a vendor. Complete line 6b if seeking a refund for an erroneous payment made on a tax return or as part of a voluntary tax payment. Complete line 6c if seeking a refund for an erroneous payment made on a sales or use tax return. Provide the case number assigned. Complete line 6d if seeking a refund on a payment made to the Clerk of Courts.

Ohio Application For Sales/Use Tax Refund Step 8: On line 7, write the reason you are seeking this refund.

Ohio Application For Sales/Use Tax Refund Step 9: Line 8 is only for vendors. If applicable, indicate whether you wish this refund to be issued in the form of a credit.

Ohio Application For Sales/Use Tax Refund Step 10: Provide all identifiying information requested on line 9.