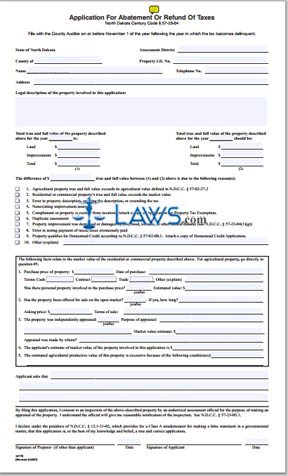

Form Application for Abatement or Refund of Taxes

INSTRUCTIONS: NORTH DAKOTA APPLICATION FOR ABATEMENT OR REFUND OF TAXES (Form 24775)

North Dakota residents who have been assessed an excessive property tax burden may file a form 24775 to request an abatement or refund. This document is found on the website of the North Dakota tax commissioner and must be filed by November 1 of the year following the year of the tax overcharge in question.

North Dakota Application For Abatement Or Refund Of Taxes 24775 Step 1: At the top of the form, enter the county and assessment district in which you are filing, the property ID number, your name, address and telephone number. Where indicated, enter the legal description of the property in question.

North Dakota Application For Abatement Or Refund Of Taxes 24775 Step 2: On the left, give the total value of the land and improvements as assessed in your county. On the right, give the actual total value of the land and improvements. Where indicated, enter the difference between the assessed value and the true value.

North Dakota Application For Abatement Or Refund Of Taxes 24775 Step 3: There are nine reasons given to explain your dispute. If none of these nine applies to your situation, check the box next to line ten and write an explanation.

North Dakota Application For Abatement Or Refund Of Taxes 24775 Step 4: The next section requires you to give facts relating to the market value of the property. On line one, enter the purchase price of the property and the date of the purchase. Indicate whether the transaction was made using cash, a contract, a trade or another form of agreement. If the latter, explain. If there was personal property involved in this transaction, give its value. Line two asks if the property has been made available for sale on the open market. If so, state for how long, the asking price and terms of the sale. Line three asks if the property was independently appraised. If so, give the name of the appraiser, the date of appraisal and the market value estimate.

North Dakota Application For Abatement Or Refund Of Taxes 24775 Step 5: On line four, give your estimation of the market value. On line five, explain why the estimated agricultural productive value of your property is excessive. Below, write what action you would like to be taken. Sign and date the form.