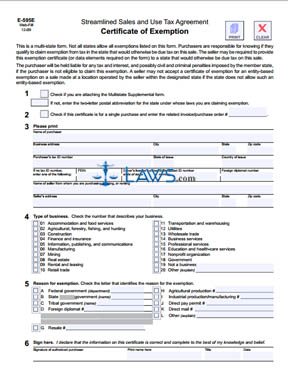

Form E 959E Streamlined Sales and Use Tax Agreement Certificate of Exemption

INSTRUCTIONS: NORTH CAROLINA STREAMLINED SALES AND USE TAX AGREEMENT CERTIFICATE OF EXEMPTION (Form E-595E)

North Carolina purchasers who operate in multiple states may file a streamlined sales and use tax exemption form documenting their operations in all member states of the Streamlined Sales Tax Project. Businesses who only operate within North Carolina may also choose to file this form. A separate packet of instructions concerning specific requirements for the state and error codes is available on the website of the North Carolina Department of Revenue, as is this form E-595E.

North Carolina Streamlined Sales And Use Tax Agreement Certificate Of Exemption E-595E Step 1: In section one, check the applicable box if you are attaching a Multistate Supplemental form. If not, give the two-letter abbreviation of the state whose laws qualify for you for exemption (NC).

North Carolina Streamlined Sales And Use Tax Agreement Certificate Of Exemption E-595E Step 2: In section two, check the box if this certificate concerns a single transaction. If so, give the invoice or purchase order number.

North Carolina Streamlined Sales And Use Tax Agreement Certificate Of Exemption E-595E Step 3: In section three, give the name of the purchaser, their business address, tax ID number or other identifying information, and the name and address of the seller.

North Carolina Streamlined Sales And Use Tax Agreement Certificate Of Exemption E-595E Step 4: In section four, indicate which of the 19 listed types of businesses describes yours with a check mark. If none apply, check "other" and provide a written explanation.

North Carolina Streamlined Sales And Use Tax Agreement Certificate Of Exemption E-595E Step 5: Section five requires you to indicate with a check mark the reason for your exemption. Line A is for federal governments, which should enter their department name. State government units should do the same on line B, as should tribal governments on line C.

North Carolina Streamlined Sales And Use Tax Agreement Certificate Of Exemption E-595E Step 6: Foreign diplomats should check line D and give their number. Those documenting a resale should check line G and give the transaction number. Lines H and J concern agricultural and industrial production or manufacturing and also require transaction numbers. Line J concerns direct pay permits, line K concerns direct mail transactions, and line L for all other exemptions.The authorized representative should then sign and date the form.