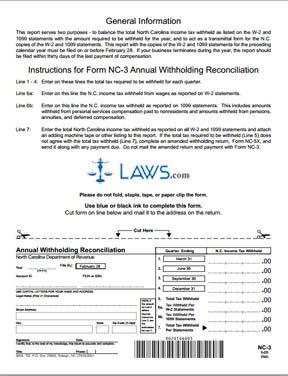

Form NC-3 Annual Withholding Reconciliation

INSTRUCTIONS: NORTH CAROLINA ANNUAL WITHHOLDING RECONCILIATION (Form NC-3)

An annual withholding reconciliation is filed by North Carolina businesses to balance the state income tax withheld as reported on your W-2 and 1099 forms with the amount required to be withheld for the year. This document can be obtained from the website maintained by the North Carolina Department of Revenue.

North Carolina Annual Withholding Reconciliation NC-3 Step 1: On the first blank line on the left, enter the year for which you are filing.

North Carolina Annual Withholding Reconciliation NC-3 Step 2: On the second blank line, enter your account ID.

North Carolina Annual Withholding Reconciliation NC-3 Step 3: On the third blank line, enter your federal employer identification number or Social Security number.

North Carolina Annual Withholding Reconciliation NC-3 Step 4: On the first line of the next section, enter the legal name of your business in capital letters.

North Carolina Annual Withholding Reconciliation NC-3 Step 5: On the second line, enter your street address.

North Carolina Annual Withholding Reconciliation NC-3 Step 6: On the third line, enter your city, state and zip code.

North Carolina Annual Withholding Reconciliation NC-3 Step 7: On line 1, enter the North Carolina income tax withheld for the quarter ending March 31.

North Carolina Annual Withholding Reconciliation NC-3 Step 8: On line 2, enter the North Carolina income tax withheld for the quarter ending June 30.

North Carolina Annual Withholding Reconciliation NC-3 Step 9: On line 3, enter the North Carolina income tax withheld for the quarter ending September 30.

North Carolina Annual Withholding Reconciliation NC-3 Step 10: On line 4, enter the North Carolina income tax withheld for the quarter ending December 31.

North Carolina Annual Withholding Reconciliation NC-3 Step 11: On line 5, enter the total sum of lines 1 through 4.

North Carolina Annual Withholding Reconciliation NC-3 Step 12: On line 6a, enter the total tax withheld as documented on your W-2 statements.

North Carolina Annual Withholding Reconciliation NC-3 Step 13: On line 6b, enter the tax withheld as documented on your 1099 statements.

North Carolina Annual Withholding Reconciliation NC-3 Step 14: On line 7, enter the total of lines of 6a and 6b.

North Carolina Annual Withholding Reconciliation NC-3 Step 15: Sign and date the bottom left-hand corner of the form, as well as providing your title and phone number.