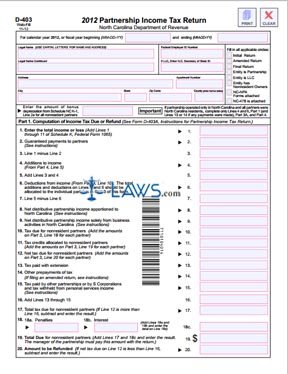

Form D-403 Partnership Income Tax Return

INSTRUCTIONS: NORTH CAROLINA PARTNERSHIP INCOME TAX RETURN (Form D-403)

Partnerships doing business in North Carolina file their state income taxes using a form D-403. This document can be obtained from the website of the North Carolina Department of Revenue.

North Carolina Partnership Income Tax Return D-403 Step 1: If you are not filing for the calendar year pre-printed on the form, enter the beginning and ending dates of your fiscal year.

North Carolina Partnership Income Tax Return D-403 Step 2: Enter your business legal name in capital letters.

North Carolina Partnership Income Tax Return D-403 Step 3: Enter your federal employer identification number. If you are a limited liability company, enter your North Carolina Secretary of State ID.

North Carolina Partnership Income Tax Return D-403 Step 4: Fill in all applicable circles on the right side of the top half of the first page.

North Carolina Partnership Income Tax Return D-403 Step 5: Enter your complete business address.

North Carolina Partnership Income Tax Return D-403 Step 6: If applicable, enter the amount of bonus depreciation documented on Schedule NC K-1, 2a for all nonresident partners.

North Carolina Partnership Income Tax Return D-403 Step 7: Part 1 concerns the computation of income tax due or the refund you are owed. Complete lines 1 through 5 as instructed.

North Carolina Partnership Income Tax Return D-403 Step 8: To complete line 6, you must first complete Part 4 on the first page.

North Carolina Partnership Income Tax Return D-403 Step 9: Complete lines 7 through 9 as directed.

North Carolina Partnership Income Tax Return D-403 Step 10: To complete lines 10 through 12, you must first complete Part 3 on the third page.

North Carolina Partnership Income Tax Return D-403 Step 11: Complete lines 13 through 20 as instructed in Part 1.

North Carolina Partnership Income Tax Return D-403 Step 12: Enter the first 10 characters of your legal name and your federal employer identification number at the top of the second page.

North Carolina Partnership Income Tax Return D-403 Step 13: Complete Part 2 as instructed to calculate the apportionment percentage for partnerships with one or more nonresident partners operating in North Carolina and one more or more states.

North Carolina Partnership Income Tax Return D-403 Step 14: A managing partner should sign and date the bottom of the fourth page.