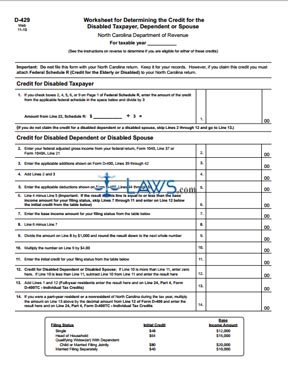

Form CD-429 Corporate Estimated Income Tax

INSTRUCTIONS: NORTH CAROLINA CORPORATE ESTIMATED INCOME TAX (Form CD-429)

Estimated income tax is calculated by subtracting tax credits claimed during the tax year from the expected income tax. Corporations operating in North Carolina who expect to owe $500 or more for a taxable year must file a form CD-249 to pay their estimated income tax. This document can be obtained from the website of the North Carolina Department of Revenue.

North Carolina Corporate Estimated Income Tax CD-429 Step 1: Enter your estimated federal taxable income on line 1.

North Carolina Corporate Estimated Income Tax CD-429 Step 2: Enter your estimated additions to your federal taxable income on line 2.

North Carolina Corporate Estimated Income Tax CD-429 Step 3: Enter your estimated deductions from your federal taxable income on line 3.

North Carolina Corporate Estimated Income Tax CD-429 Step 4: Add lines 1 and 2, then subtract line 3 from the resulting sum. Enter the resulting difference on line 4.

North Carolina Corporate Estimated Income Tax CD-429 Step 5: Enter your estimated nonapportionable income on line 5.

North Carolina Corporate Estimated Income Tax CD-429 Step 6: Subtract line 5 from line 4. Enter the resulting difference on line 6.

North Carolina Corporate Estimated Income Tax CD-429 Step 7: Enter the amount of line 6 estimated to be apportioned to North Carolina on line 7.

North Carolina Corporate Estimated Income Tax CD-429 Step 8: Enter the amount of line 5 expected to be directly allocated to North Carolina on line 8.

North Carolina Corporate Estimated Income Tax CD-429 Step 9: Add lines 7 and 8 and enter the resulting sum on line 9.

North Carolina Corporate Estimated Income Tax CD-429 Step 10: Multiply line 9 by 6.90% and enter the resulting product on line 10.

North Carolina Corporate Estimated Income Tax CD-429 Step 11: Enter your estimated tax credits on line 11.

North Carolina Corporate Estimated Income Tax CD-429 Step 12: Subtract line 11 from line 10. Enter the resulting difference on line 12. This is your estimated North Carolina net tax due.

North Carolina Corporate Estimated Income Tax CD-429 Step 13: Transfer the value from line 12 of the worksheet to the box labeled "Amount of this payment" on the bottom half of the form. Provide all requesting identifying information on the left side of the form.