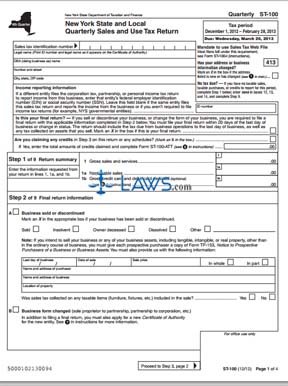

Form ST-100 Quarterly Sales and Use Tax Return

INSTRUCTIONS: NEW YORK STATE AND LOCAL QUARTERLY SALES AND USE TAX RETURN (Form ST-100)

New York businesses whose combined total of taxable receipts and other transactions subject state tax is $300,00 or more in a quarter must file a form ST-100 on a monthly basis. Most businesses are required to submit this form electronically if they do not have a tax preparer, complete the forms on their computer and have access to broadband internet. This article discusses the paper version of this document, which is found on the website of the New York State Department of Taxation and Finance.

New York State And Local Quarterly Sales And Use Tax Return ST-100 Step 1: At the top of the form, enter your assigned sales tax identification number, the legal name of the business, the name under which business is conducted and the street address of the business.

New York State And Local Quarterly Sales And Use Tax Return ST-100 Step 2: In section one, enter your gross total services and sales for the period in question. Sales tax should not be included in this amount.

New York State And Local Quarterly Sales And Use Tax Return ST-100 Step 3: Section two details additional schedules which must be filed by certain businesses or businesses located in certain areas. Review this section carefully to see if any of these schedules must be completed and attached with your return.

New York State And Local Quarterly Sales And Use Tax Return ST-100 Step 4: In section three, calculate your total sales and use tax owed by multiplying the sum of your taxable services and credits and your purchases subject to tax by the rate of the county or sub-area in which your business is located. This section provides the appropriate percentage for every area. Only complete the line which applies to your business.

New York State And Local Quarterly Sales And Use Tax Return ST-100 Step 5: Section four concerns special taxes, while section five concerns tax credits and advance payments.

New York State And Local Quarterly Sales And Use Tax Return ST-100 Step 6: Follow the instructions to calculate your taxes due in section sex, your vendor collection credit or penalty and interest due in section seven, and your final total in section eight. Sign and date the bottom of the form and provide all identifying and contact information requested.