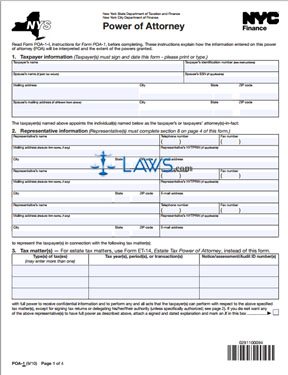

Form POA-1 Power of Attorney

INSTRUCTIONS: NEW YORK POWER OF ATTORNEY (Form POA-1)

A power of attorney form grants another person the legal authority to perform actions on your behalf. This New York Power of Attorney form specifically concerns issues of taxation with regards to either the state or New York City. The form can be obtained from the website of the New York Department of Taxation and Finance.

Power of Attorney POA-1 Step 1: Under section 1, "Taxpayer information," enter your name, the name of your spouse if filing jointly, your Social Security number or taxpayer identification number, and your mailing address.

Power of Attorney POA-1 Step 2: Under section 2, "Representative information," enter the name, address and contact information of the person you wish to grant power of attorney. You may enter up to three people's names on one form. Enter the New York Tax Preparation Registration Identification Number (NYTPRIN) if applicable.

Power of Attorney POA-1 Step 3: Under section 3, "Tax matter(s)," specify the types of taxes you wish for representatives to be able to handle, the years or specific transactions, and any applicable notice/assessment/audit ID numbers. This will confer all powers except for the right to sign for tax returns or appoint another person to be your representative. These must be specifically granted in the two lines at the top of the second page.

Power of Attorney POA-1 Step 4: Under section 4, "Retention/revocation of prior power(s) of attorney," place an x in the box if you do not want this form to nullify previous powers of attorney. If so, you must attach copies of previous power of attorney forms you wish to still keep in effect.

Power of Attorney POA-1 Step 5: Certain statutory notices will automatically be sent to your first named representative unless you specify under section 6, "Notices and other communications," that they should be sent to another person with this authority under section 6.Write "none" if you do not wish for representatives to receive such papers.

Power of Attorney POA-1 Step 6: Print and sign your name, along with the date. This must be done in front of a notary or two witnesses with no stake in your financial matters. This does not apply if the designated representative is an attorney, CPA, or an agent who can practice before the IRS.