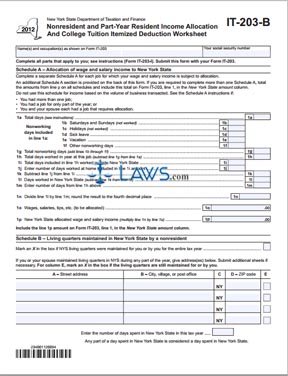

Form IT-203-B Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet

INSTRUCTIONS: NEW YORK NONRESIDENT AND PART-YEAR RESIDENT INCOME ALLOCATION AND COLLEGE TUITION ITEMIZED DEDUCTION WORKSHEET (Form IT-203-B)

Nonresidents and part-year residents of New York who must file a form IT-203 must first complete the IT-203-B worksheet. Both forms can be obtained from the website of the New York State Department of Taxation and Finance.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 1: Enter your name and occupation as it appears on your form IT-203.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 2: Enter your Social Security number.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 3: Schedule A concerns allocation of wage and salary income to New York. Complete lines 1a through 1p as directed.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 4: Schedule B concerns living quarters maintained in New York state by a nonresident. For all applicable residences, enter the street address in column A, the city, village or post office in column B, and the zip code in column D. Mark an X in column E if the living quarters are still maintained by or for you.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 5: Enter your Social Security number at the top of the second page.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 6: Schedule C is an itemized college tuition deduction worksheet. If applicable, complete this section as instructed.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 7: At the bottom of Section C, enter the number of days spent in New York state during the tax year in question.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 7: A separate Schedule A is provided at the bottom of the second page if you must document more than one job.

New York Nonresident And Part-Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet IT-203-B Step 8: Attach this worksheet to your form IT-203 return when filing.