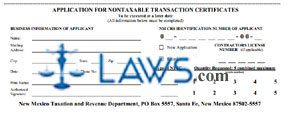

Form ACD 31050 Application for Nontaxable Transaction Certificate

INSTRUCTIONS: NEW MEXICO APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES (Form ACD 31050)

In order to file a nontaxable transaction certificate in New Mexico a seller, you must be registered with the state's Taxation and Revenue Department, be in compliance, and file the form ACD 31050 discussed in this article. While there is an online paperless alternative available, you may also complete this form and mail it to the address listed. This document is found on the website of the New Mexico Taxation and Revenue Department.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 1: Detach the application from the instructions along the dotted line.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 2: Give your business name, mailing address, city state and zip code.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 3: Give the date of this application and a business phone number.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 4: The seller or their authorized representative should print and sign their name.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 5: Give your CRS number if one has been assigned to your business.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 6: Indicate with a check mark if this is a new application or a reorder application.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 7: If applicable, enter a contractors or license number.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 8: Under the column labeled "Type of NTTC," give the number of the type of the non-taxable transaction certificate code you are claiming. Those listed in the instructions include Type 2 purchases of tangible personal property for resales, Type 5 purchases of services performed on manufactured products, Type 6 construction materials purchases, Type 9 purchases made by government units or credit unions, Type 15 purchases by qualified federal contractors, and Type 16 purchases made by film production companies and accredited foreign mission.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 9: Circle the combined number of exemptions sought of each type on each line. The combined total of the exemptions sought cannot be greater than five.

New Mexico Application For Nontaxable Transaction Certificates ACD 31050 Step 10: Rather than mailing the form, you may also choose to file it in person with your local district office.