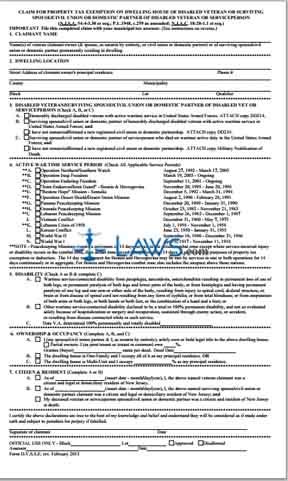

Form Claim for Property Tax Exemption for Disabled Veterans

INSTRUCTIONS: NEW JERSEY CLAIM FOR PROPERTY TAX EXEMPTION ON DWELLING HOUSE OF DISABLED VETERAN OR SURVIVING SPOUSE/CIVIL UNION OR DOMESTIC PARTNER OF DISABLED VETERAN OR SERVICEPERSON (Form D.V.S.S.E.)

Disabled military veterans who live in New Jersey, as well as their surviving spouses, civil union or domestic partners, may file a form D.V.S.S.E. to obtain a property tax exemption on their primary residence. This form is available on the website of the state of New Jersey.

New Jersey Claim For Property Tax Exemption On Dwelling House Of Disabled Veteran Or Surviving Spouse/Civil Union Or Domestic Partner Of Disabled Veteran Or Serviceperson D.V.S.S.E. Step 1: In sectio one, enter the name of the person filing the claim.

New Jersey Claim For Property Tax Exemption On Dwelling House Of Disabled Veteran Or Surviving Spouse/Civil Union Or Domestic Partner Of Disabled Veteran Or Serviceperson D.V.S.S.E. Step 2: In section two, give the complete address of the property in question, as well as its phone number.

New Jersey Claim For Property Tax Exemption On Dwelling House Of Disabled Veteran Or Surviving Spouse/Civil Union Or Domestic Partner Of Disabled Veteran Or Serviceperson D.V.S.S.E. Step 3: Check statement A, B or C as applicable in section three.

New Jersey Claim For Property Tax Exemption On Dwelling House Of Disabled Veteran Or Surviving Spouse/Civil Union Or Domestic Partner Of Disabled Veteran Or Serviceperson D.V.S.S.E. Step 4: In section four, check the box next to all active duty service periods served by the disabled veteran.

New Jersey Claim For Property Tax Exemption On Dwelling House Of Disabled Veteran Or Surviving Spouse/Civil Union Or Domestic Partner Of Disabled Veteran Or Serviceperson D.V.S.S.E. Step 5: In section five, indicate with a check mark what type of disability from those listed in sub-sections A and B applies. In sub-section C, give the date on which the Department of Veterans Affair certified the disability.

New Jersey Claim For Property Tax Exemption On Dwelling House Of Disabled Veteran Or Surviving Spouse/Civil Union Or Domestic Partner Of Disabled Veteran Or Serviceperson D.V.S.S.E. Step 6: Section six concerns occupancy, while section seven concerns residency. Check all statements which apply. Sign and date the form.