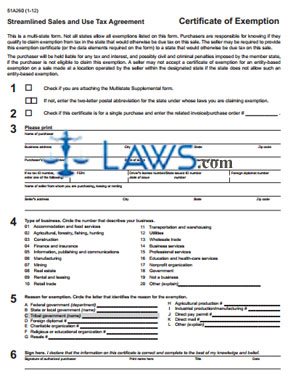

Form Certificate Exemption Streamlined Sales and Use Tax Agreement

INSTRUCTIONS: KENTUCKY STREAMLINED SALES AND USE TAX AGREEMENT CERTIFICATE OF EXEMPTION (Form 51A260)

Kentucky is a member state in the Streamlined Sales Tax Governing Board which supervises this form of business tax filing. This form can be used to document business in one state or multiple states and consolidates the information which must be provided when certifying that a purchase is exempt from sales and use tax. The document can be found on the website of the Department of Revenue of Kentucky.

Kentucky Streamlined Sales And Use Tax Agreement Certificate Of Exemption 51A260 Step 1: If you are attaching a Multistate Supplement Form, indicate this with a check mark in section one.

Kentucky Streamlined Sales And Use Tax Agreement Certificate Of Exemption 51A260 Step 2: If filing only for Kentucky, enter "KY" where indicated.

Kentucky Streamlined Sales And Use Tax Agreement Certificate Of Exemption 51A260 Step 3: In section two, if this agreement concerns a single purchase, enter the invoice or purchase order number. Otherwise, this certificate will take blanket effect and be applied to all similar transactions by the seller.

Kentucky Streamlined Sales And Use Tax Agreement Certificate Of Exemption 51A260 Step 4: In the third section, give your name, business address, and tax ID, including the state and country in which it was issued. If you do not have a tax ID number, enter the Federal Employer Identification Number assigned to your business or your driver's license or state ID number. If you are a foreign diplomat, give your number.

Kentucky Streamlined Sales And Use Tax Agreement Certificate Of Exemption 51A260 Step 5: In the fourth section, circle the statement which describes your type of business. If none of the 19 listed answers apply, provide an explanation on line 20.

Kentucky Streamlined Sales And Use Tax Agreement Certificate Of Exemption 51A260 Step 6: In the fifth section, circle the letter next to the statement which describes your exemption justification. If none of the reasons listed on lines A through K apply, provide an explanation on line L.

Kentucky Streamlined Sales And Use Tax Agreement Certificate Of Exemption 51A260 Step 7: An authorized purchaser should sign and print their name in the sixth section, as well as providing their title and the date.

Kentucky Streamlined Sales And Use Tax Agreement Certificate Of Exemption 51A260 Step 8: The second page is a multistate supplemental form.