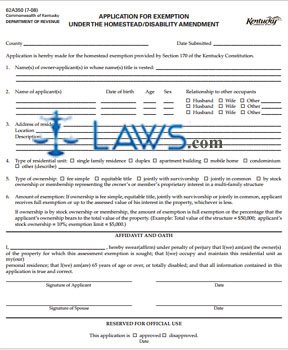

Form Application for Homestaed Exempion

INSTRUCTIONS: KENTUCKY APPLICATION FOR EXEMPTION UNDER THE HOMESTEAD/DISABILITY ACT (Form 62A350)

Disabled Kentucky residents can file a form 62A350 annually to seek a property tax exemption. In order to qualify, you must receive disability payments, been classified as disabled the entire year and submit verification documentation of your status annually if you are under the age of 65. Veterans applying for this exemption only need to file once.

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 1: Enter the name of the county where you are filing and the date you submit your form.

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 2: In section one, give the name or names of the applicants whose names are on the title to the property.

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 3: In section two, give the names, ages, sex and relationship to other occupants of all applicants.

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 4: In section three, give the address of the residence in question, the phone number and email address, and the parcel identification number (if known).

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 5: In section four, indicate with a check mark whether the property is a single family residence, duplex, apartment building, mobile home, condominium or other type of structure. If the latter, provide a written explanation.

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 6: In section five, indicate with a check mark whether the property is owned on a fee simple, equitable title, joint survivorship, joint common, stock ownership, membership or proprietary interest status.

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 7: Below "Affidavit And Oath," enter your name where indicated.

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 8: Sign and date the form. If you file taxes jointly with your spouse, they should do the same.

Kentucky Application For Exemption Under The Homestead/Disability Act 62A350 Step 9: Submit the form to the property valuation administrator of the county in which the residence is located by December 31. You must submit verification of your age, such as a copy of your MediCare card or birth certificate.