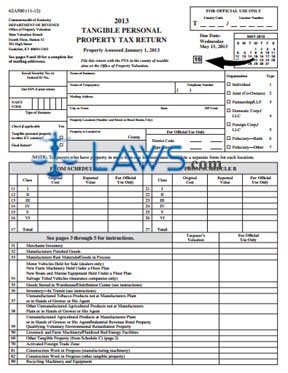

Form 62A500 Tangible Personal Property Tax Return

INSTRUCTIONS: KENTUCKY TANGIBLE PERSONAL PROPERTY TAX RETURN (Form 62A500)

Kentucky business owners must file an annual tangible personal property tax return documenting all such assets related to their companies. This form 62A500 is available on the website of the Kentucky Department of Revenue. This article discusses the form itself, which is bundled with instructions and various other forms.

Kentucky Tangible Personal Property Tax Return 62A500 Step 1: At the top of the form, enter your Social Security number, business name and address, and the location of the property. Indicate with a check mark the type of business structure which applies.

Kentucky Tangible Personal Property Tax Return 62A500 Step 2: Complete Schedule A on page 3 first. Schedule A requires you to list property such as furniture, fixtures, billboards and construction equipment.

Kentucky Tangible Personal Property Tax Return 62A500 Step 3: Schedule B should be completed first. This form requires you to detail property such as pollution control facilities, manufacturing machinery and other manufacturing assets.

Kentucky Tangible Personal Property Tax Return 62A500 Step 4: Transfer all information from Schedules A and B to form 62A500 where indicated on the first page.

Kentucky Tangible Personal Property Tax Return 62A500 Step 5: Complete lines 31 through 90 on the first page. These sections require you to give your current valuation of assets including inventory, finished goods, raw materials, motor vehicles held for sale, inventory in transit, livestock, construction work in progress and recycling machinery.

Kentucky Tangible Personal Property Tax Return 62A500 Step 6: Complete Schedule C on the second page. This requires you to provide a description and current valuation for other tangible personal property not listed elsewhere on the form, including coin and stamp collections, research libraries, aircraft for hire, precious metals, and documented watercraft used for commercial purposes.

Kentucky Tangible Personal Property Tax Return 62A500 Step 7: On the bottom of the second page, you may enter any additional information you feel is necessary concerning the classification of your assets or alternative valuations.

Kentucky Tangible Personal Property Tax Return 62A500 Step 8: If you have an aircraft, you must also file a form 62A500-A to document these assets, while a form 62A500-W documents watercraft. Form 62A500-L concerns leased equipment and form 62A500-C concerns consigned equipment,

Kentucky Tangible Personal Property Tax Return 62A500 Step 9: Form 62A500-S1 is for auto dealers only, while form 62A500-M1 is only for boat dealers.