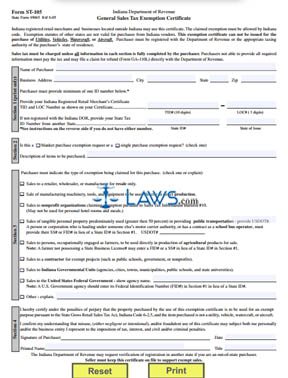

Form ST 105 General Sales Tax Exemption Certificate

INSTRUCTIONS: INDIANA GENERAL SALES TAX EXEMPTION CERTIFICATE (Form ST-105)

Registered Indiana retailers and out-of-state businesses may both use a form ST-105 to certify that a purchase of tangible personal property is exempt from collection of state sales tax. This article discusses the certificate, which can be found on the forms repository website maintained by the government of Indiana. Note that this form does not apply to purchases of utilities, vehicles, watercraft or aircraft.

Indiana General Sales Tax Exemption Certificate ST-105 Step 1: In Section 1, give the name of the purchaser, their business address and provide your Indiana Retail Merchant's Certificate number. If you do not have one, provide your state tax ID number from another state and note which state issued it.

Indiana General Sales Tax Exemption Certificate ST-105 Step 2: In section 2, note whether this certificate applies to one purchase or is intended to act as a blanket certificate covering all subsequent purchases from the seller in question.

Indiana General Sales Tax Exemption Certificate ST-105 Step 3: Write a description of the items which will be purchased.

Indiana General Sales Tax Exemption Certificate ST-105 Step 4: In section 3, you must indicate with a check mark which of the listed types of exemptions you are claiming. The first option concerns purchases made for the the purpose of resale.

Indiana General Sales Tax Exemption Certificate ST-105 Step 5: The second option concerns sales of equipment and tools to be used in direct production.

Indiana General Sales Tax Exemption Certificate ST-105 Step 6: The third option concerns sales to qualifying nonprofit organizations.

Indiana General Sales Tax Exemption Certificate ST-105 Step 7: The fourth option concerns sales of products used primarily for public transportation.

Indiana General Sales Tax Exemption Certificate ST-105 Step 8: The fifth option concerns sales of products to be used directly in agricultural activities.

Indiana General Sales Tax Exemption Certificate ST-105 Step 9: The sixth option concerns sales to a contractor working on an exempt project.

Indiana General Sales Tax Exemption Certificate ST-105 Step 10: The seventh option concerns sales to state government units.

Indiana General Sales Tax Exemption Certificate ST-105 Step 11: The eight option concerns sales to federal government units. Give the name of the agency.

Indiana General Sales Tax Exemption Certificate ST-105 Step 12: If none of the above, provide an explanation. The purchaser should sign and date the form.