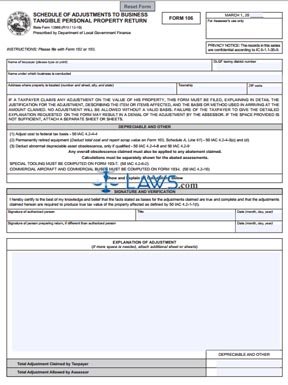

Form 12980 Schedule of Adjustments to Business Tangible Personal Property Return

INSTRUCTIONS: INDIANA SCHEDULE OF ADJUSTMENTS TO BUSINESS TANGIBLE PERSONAL PROPERTY RETURN (Form 12980)

Indiana farms and businesses can seek an adjustment to evaluations of their tangible personal property on a federal tax basis, when they permanently retire equipment, or due to abnormal depreciable asset obsolescence. If claiming this last basis for exemption, you must apply obsolescence to the value of any abatement and adjustment you are seeking. This form 12980 should be filed along with a form 102 (for farms) or form 103 (for all other businesses). Special tools must be noted on form 103-T, while the value of commercial aircraft and buses must be computed on form 103-I. All these documents can be found on the website of the government of Indiana. The form should be completed by printing or typing your responses. All information provided on this form will remain confidential.

Indiana Schedule Of Adjustments To Business Tangible Personal Property Return 12980 Step 1: Enter the name of the taxpayer filing.

Indiana Schedule Of Adjustments To Business Tangible Personal Property Return 12980 Step 2: Enter the taxing district number of the business.

Indiana Schedule Of Adjustments To Business Tangible Personal Property Return 12980 Step 3: Enter the name under which the business is operated.

Indiana Schedule Of Adjustments To Business Tangible Personal Property Return 12980 Step 4: Enter the address, township and zip code of the property.

Indiana Schedule Of Adjustments To Business Tangible Personal Property Return 12980 Step 5: The second half of the form provides a blank space labeled "Explanation of Adjustment." In this section, you must explain in detail the reason for the requested adjustment. This explanation must include a list of all items involved, and the basis used to calculate the amount of the adjustment you are seeking. Include all calculations. Attach additional sheets as needed to provide a thorough explanation.

Indiana Schedule Of Adjustments To Business Tangible Personal Property Return 12980 Step 6: Enter the total adjustment you are seeking in the bottom right corner reserved for this purpose.

Indiana Schedule Of Adjustments To Business Tangible Personal Property Return 12980 Step 7: Sign the middle of the page, and enter your job title and the date.

Indiana Schedule Of Adjustments To Business Tangible Personal Property Return 12980 Step 8: File this form with your county assessor.