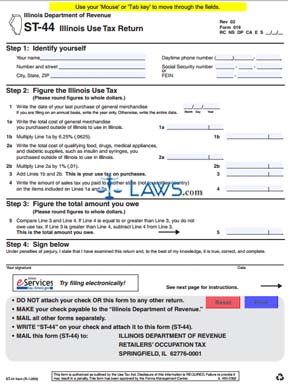

Form ST-44 Use Tax Return

INSTRUCTIONS: ILLINOIS USE TAX RETURN (Form ST-44)

All Illinois residents must pay use tax on any tangible personal property acquired for use within the state on which no state sales tax was paid. If your total use tax liability for the year is $600 or less, you are only required to file form ST-44 and submit on an annual basis. If greater than $600, you must file and pay on the last day of the month following the month in which the purchase was made. The form is found on the website of the Illinois Department of Revenue.

Illinois Use Tax Return ST-44 Step 1: In the section labeled "Step 1," give your name, address, daytime telephone number and Social Security or Federal Employer Identification Number.

Illinois Use Tax Return ST-44 Step 2: On line 1, enter the last date of your purchase of applicable merchandise. If filing an annual return, you only need to enter the year. Otherwise, you must enter the month, date and year.

Illinois Use Tax Return ST-44 Step 3: On line 1a, enter the total cost of merchandise purchased outside of Illinois for use within the state. Throughout the form, all figures must be rounded to the nearest whole dollar.

Illinois Use Tax Return ST-44 Step 4: Multiply line 1a by the use tax rate of 6.25%. Enter the resulting product on line 1b.

Illinois Use Tax Return ST-44 Step 5: On line 2a, enter the total cost of qualifying food, drugs, medical appliances and diabetic supplies purchased outside the state.

Illinois Use Tax Return ST-44 Step 6: Multiply line 2a by the use tax rate of 1% for such purchases. Enter the resulting product on line 2b.

Illinois Use Tax Return ST-44 Step 7: Add lines 1b and 2b and enter the resulting sum on line 3.

Illinois Use Tax Return ST-44 Step 8: On line 4, enter the amount of sales tax paid to another state on these items.

Illinois Use Tax Return ST-44 Step 9: If line 4 is greater than line 3, you are not required to pay use tax. Otherwise, subtract line 4 from line 3 and enter the resulting difference on line 5.

Illinois Use Tax Return ST-44 Step 10: Sign and date the form. You may file electronically or submit the completed form by mail with a check made payable to the "Illinois Department of Revenue."