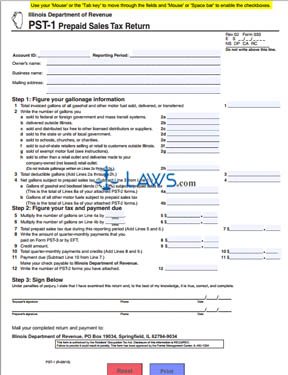

Form PST-1 Prepaid Sales Tax Return

INSTRUCTIONS: ILLINOIS PREPAID SALES TAX RETURN (Form PST-1)

Illinois merchants of fuel for motor vehicles must file a form PST-1 to document their prepaid sales tax on all such transactions. The document is available on the website of the Illinois Department of Revenue.

Illinois Prepaid Sales Tax Return PST-1 Step 1: At the top of the form, enter your account ID number, the dates of the reporting period in question, the name of the business owner, the name of the business, and its mailing address.

Illinois Prepaid Sales Tax Return PST-1 Step 2: On line 1, enter the total invoiced gallons of all motor vehicle sold in the reporting period.

Illinois Prepaid Sales Tax Return PST-1 Step 3: On lines 2a through 2h, you should itemize deductible gallons sold to federal or foreign governments and mass transit systems, delivered outside of the state, sold and distributed tax free to other licensed suppliers and distributors, sold to state or local government agencies, sold to schools, churches or charitable organizations, sold to out-of-state retailers, sales of exempt fuels such as ethanol, or sold to someone other than a retail outlet or deliveries made to a company-owned outlet.

Illinois Prepaid Sales Tax Return PST-1 Step 4: Add lines 2a through 2h and enter the sum on line 3.

Illinois Prepaid Sales Tax Return PST-1 Step 5: Subtract line 3 from line 2 to determine your net gallons sold subject to prepaid sales tax. Enter this number on line 4.

Illinois Prepaid Sales Tax Return PST-1 Step 6: You must complete and attach form PST-2 to complete lines 4a and 4b.

Illinois Prepaid Sales Tax Return PST-1 Step 7: Consult the tax rate database on the website of the Illinois Department of Revenue to determine the tax rate in your area. On line 5, multiply line 4a by this rate. Multiply line 4b by this rate and enter the product on line 6. On line 7, enter the sum of lines 5 and 6.

Illinois Prepaid Sales Tax Return PST-1 Step 8: On line 8, enter the sum of quarter-monthly payments made with form PST-3 or electronically. If you have any tax credit, enter this on line 9. Add lines 8 and 9, enter the sum on line 10, and subtract this from line 7 to determine your balance due. On line 12, write how many PST-2 forms are attached.