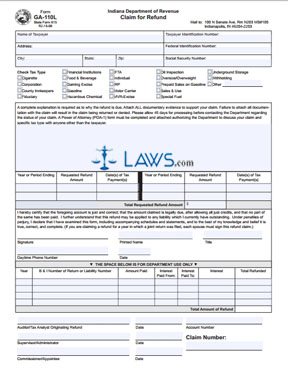

Form GA-110L Claim for Refund

INSTRUCTIONS: INDIANA CLAIM FOR REFUND (Form GA-110L)

Indiana residents and businesses who believe they have overpaid any of their taxes may use a form GA-110L to request a refund from the state Department of Revenue. This document can be found on their website.

Indiana Claim For Refund GA-110L Step 1: In the first box of the table at the top of the page, give your name.

Indiana Claim For Refund GA-110L Step 2: In the second box, give your taxpayer identification number.

Indiana Claim For Refund GA-110L Step 3: In the third box, give your street address.

Indiana Claim For Refund GA-110L Step 4: In the fourth box, give your federal identification number.

Indiana Claim For Refund GA-110L Step 5: On the third line, provide your city, state, zip code and Social Security number.

Indiana Claim For Refund GA-110L Step 6: In the section below this table, check the type of tax or taxes for which you are seeking a refund. The taxes listed are for cigarettes, corporations, county innkeepers, fiduciaries, financial institutions, food and beverages, gaming excises, gasoline, hazardous chemicals, IFTA, individual returns, IRP, motor carriers, MRV-excise, oil inspection, oversize/overweight transport, prepaid gasoline sales tax, sales & use, special fuel, underground storage, withholding taxes from wages, or other. If the latter, explain.

Indiana Claim For Refund GA-110L Step 7: In the blank space provided, give a written explanation for why you are seeking a refund. You must attach all documentation substantiating your claims of overpayment or any other basis for a refund.

Indiana Claim For Refund GA-110L Step 8: In the table provided below this space, enter the year or the end date of the period in question for each tax for which you are seeking a refund, the amount of the refund you are requesting, and the date on which the tax payment was made.

Indiana Claim For Refund GA-110L Step 9: Enter the total of all tax refunds you are requesting in the box provided.

Indiana Claim For Refund GA-110L Step 10: Sign and print your name, give your title, and give a daytime telephone number and the date.

Indiana Claim For Refund GA-110L Step 11: If you wish for someone else to be authorized to speak with a Department of Revenue official about your requested refund, you must submit a power of attorney form (form POA-1) with your refund application.