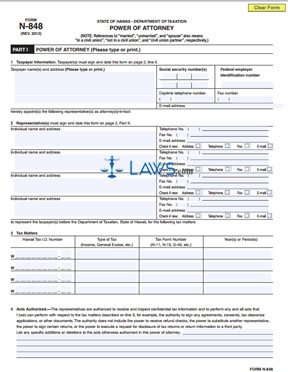

Form N848 Power of Attorney

INSTRUCTIONS: HAWAII POWER OF ATTORNEY

A power of attorney form grants someone else authority to make decisions on your behalf. The form discussed here specifically concerns the power of authority of matters involving taxation and no other legal issues. This document can be obtained from the website of the government of Hawaii.

Power of Attorney Step 1: Where indicated, write your full name and address. Next to this, write your Social Security number and provide all contact information requested. If you have a federal employer identification number, include this as well.

Power of Attorney Step 2: Under section two, you may name up to four people who you wish to grant power of attorney. Include their full names and addresses, as well as all contact information.

Power of Attorney Step 3: Under section 3, indicate your Hawaii Tax Identification Number, the type of taxes you are giving representatives authority over, as well as the appropriate tax form numbers and years concerned.

Power of Attorney Step 4: Under section 4, detail the authority specifically being granted in addition to those already listed, which largely concern the signing of documents. Note that a representative cannot appoint another representative, receive tax refund checks, or request that information or tax returns be provided to a third party.

Power of Attorney Step 5: List any specific powers not detailed or prohibited above which you wish to grant to a representative.

Power of Attorney Step 6: If you have filed a previous power of attorney form, it will be automatically revoked unless you check the box under Section 6 stating you do not wish for this to be the case. You must attach a copy of this previously filed form if you wish for it to stay in effect.

Power of Attorney Step 7: Sign and date this document. Husbands and wives signing this document must sign it jointly.

Power of Attorney Step 8: Under Part II, all designated representative(s) must print and sign their name, the date and the last four digits of their Social Security number.

Power of Attorney Step 9: To take effect, a copy of this document must be submitted to the tax department with every document for which these powers are authorized.