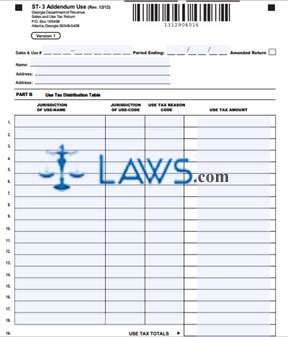

Form ST-3 Addendum Use

INSTRUCTIONS: GEORGIA ADDENDUM USE (Form ST-3)

Registered businesses and taxpayers in Georgia report their sales and use tax owed to the state's Department of Revenue by completing a form ST-3. Use tax is paid on all tangible personal property used in the state for which no sales tax was paid. If there is not sufficient space to list use tax owed from all districts in which you do business or from which purchases were made, you may attach the addendum form discussed in this article to provide additional documentation. The form is available on the website of the Georgia Department of Revenue.

Georgia Addendum Use ST-3 Step 1: Enter your sales and use tax permit number.

Georgia Addendum Use ST-3 Step 2: Enter the month, date and year of the end of the period for which you are filing.

Georgia Addendum Use ST-3 Step 3: If you are filing an amended form ST-3, indicate this with a check mark.

Georgia Addendum Use ST-3 Step 4: Enter your name and complete address including city, state and zip code.

Georgia Addendum Use ST-3 Step 4: In the first column of the table provided, enter the name of the jurisdiction in which the tangible personal property being detailed was first put into use.

Georgia Addendum Use ST-3 Step 5: In the second column, enter the code number for this jurisdiction. This information can be found on the jurisdiction tax rate chart made available on the website of the Georgia Department of Revenue.

Georgia Addendum Use ST-3 Step 6: In the third column, enter the use tax reason code for each purchase.

Georgia Addendum Use ST-3 Step 7: In the fourth column, enter the amount of use tax owed. You will need to multiply the cost of each purchase the rate in the jurisdiction in which the personal property was put to use. The applicable tax rate can also be found on the jurisdiction tax rate chart.

Georgia Addendum Use ST-3 Step 8: Total all values entered in the fourth column at the bottom of the page.

Georgia Addendum Use ST-3 Step 9: Transfer this value to line 27 of your form ST-3 and combine it with the values recorded there to determine the total use tax owed. Transfer this number to line 5 of part A.