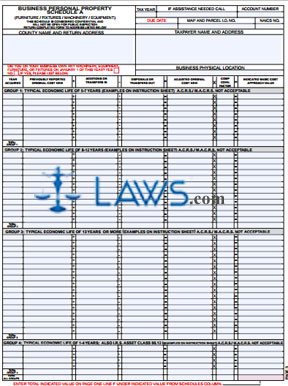

Form PT-50P Business Personal Property Tax Return

INSTRUCTIONS: GEORGIA BUSINESS PERSONAL PROPERTY TAX RETURN (Form PT-50P)

Every Georgia business must annually file a personal property tax return detailing assets related to its business. This form PT-50P can be found on the website of the Georgia Department of Revenue and includes further instructions.

Georgia Business Personal Property Tax Return PT-50P Step 1: At the top of the first page, enter all identifying information requested about the taxpayer and their business.

Georgia Business Personal Property Tax Return PT-50P Step 2: The section labeled "Personal Property Strata" requires you to give the taxpayer returned value as of the beginning of the year of all furniture, fixtures, machinery and equipment, as well as of all inventory, freeport inventory and other personal property. Enter the total value at the bottom of the page.

Georgia Business Personal Property Tax Return PT-50P Step 3: The taxpayer must sign and print their name at the bottom of the first page, as well as providing their title, the date and a contact phone number.

Georgia Business Personal Property Tax Return PT-50P Step 4: The section headed "General Information" must be completed in full. Lines one through nine request information about the business and its owners.

Georgia Business Personal Property Tax Return PT-50P Step 5: Lines 10 through 13 concern storage of records and the address and contact information for your buildings.

Georgia Business Personal Property Tax Return PT-50P Step 6: Lines 14 through 20 require various information about your business operations.

Georgia Business Personal Property Tax Return PT-50P Step 7: Page three contains Schedule A. On this form, you must detail all furniture, fixtures, machinery and equipment. Group these assets by their age following the examples given in the instructional sheets in this document. Perform all calculations required to determine their value.

Georgia Business Personal Property Tax Return PT-50P Step 8: Page four contains Schedule B, which requires you to detail your inventory.

Georgia Business Personal Property Tax Return PT-50P Step 9: Schedule C requires you to detail construction in progress, consigned goods, leased or rented equipment, and additions or items transferred to your property. Attach supplemental sheets as necessary.

Georgia Business Personal Property Tax Return PT-50P Step 10: File the form by April 1 with the tax commissioner or assessor of the county where the property is located.