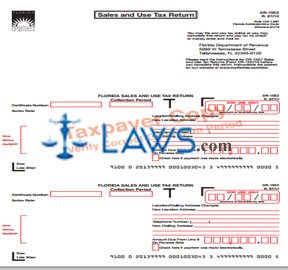

Form DR-15EZ Sales and Use Tax Return

INSTRUCTIONS: FLORIDA SALES AND USE TAX RETURN (Form DR-15EZ)

Florida businesses which have been assigned a sales and use tax certificate can use a form DR-15EZ to document and file these taxes with the state department of revenue. The document can be found on their website.

Florida Sales And Use Tax Return DR-15EZ Step 1: You must complete the second page first. Two copies of the return are on this page. Keep one for your records and file the other with the Department of Revenue.

Florida Sales And Use Tax Return DR-15EZ Step 2: On line one, enter your gross sales for the collection period.

Florida Sales And Use Tax Return DR-15EZ Step 3: On line two, enter your exempt sales.

Florida Sales And Use Tax Return DR-15EZ Step 4: On line three, enter all taxable sales and purchases, including those made over the internet or from out-of-state retailers.

Florida Sales And Use Tax Return DR-15EZ Step 5: On line four, enter the total tax collected. This should include any local tax owed along with the state rate of 6%. You may find all local tax rates listed on form DR-2X.

Florida Sales And Use Tax Return DR-15EZ Step 6: On line five, enter all lawful deductions.

Florida Sales And Use Tax Return DR-15EZ Step 7: On line six, enter any credit from previous returns.

Florida Sales And Use Tax Return DR-15EZ Step 8: Subtract the sum of lines five and six from line four. Enter the result on line seven.

Florida Sales And Use Tax Return DR-15EZ Step 9: If filing late, consult form DR-15DSS to determine your penalty and interest due. Enter this on line eight.

Florida Sales And Use Tax Return DR-15EZ Step 10: Enter the total of lines seven and eight on line nine. Transfer this to the boxes where indicated at the bottom of the first page.

Florida Sales And Use Tax Return DR-15EZ Step 11: On the first page, enter your business certification number where indicated and the applicable collection period.

Florida Sales And Use Tax Return DR-15EZ Step 12: Enter your local surtax rate where indicated.

Florida Sales And Use Tax Return DR-15EZ Step 13: Enter your name and address.

Florida Sales And Use Tax Return DR-15EZ Step 14: Sign and date the second page. Include your telephone number.