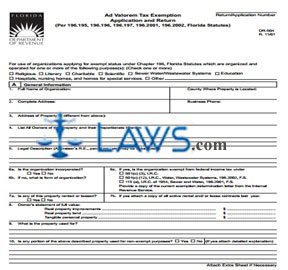

Form DR-504 Ad Valorem Tax Exemption Application and Return

INSTRUCTIONS: FLORIDA AD VALOREM TAX EXEMPTION APPLICATION AND RETURN (Form DR-504)

Florida organizations which are religious, charitable or scientific, as well as nursing homes, hospitals, special services homes and not-for-profit corporations in the fields of sewage, waste and wastewater must file an annual form DR-504. This document qualifies them for a property tax exemption. The document is found on the website of the Florida Department of Revenue.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 1: At the top of the form, place a check mark next to the statement which describes your organization.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 2: Section A is for general information about your business. Enter its name, mailing address, address of the property in question (if different), business phone number and county. List all owners and give their percentage of interest in the property. Enter a legal description or the property identification number.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 3: Question one asks if the organization is incorporated. If so, note under which law it is exempt from federal income tax and attach a copy of your current exemption determination from the IRS. If not, describe the organization's form.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 4: Question two asks if any of this property is rented or leased. If so, attach copies of all related questions.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 5: Question three requires you to detail the full value of the real property, improvements made and tangible personal property located there.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 6: Question four asks you to describe how the property is used.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 7: Question five asks if any part of this property is used for non-exempt purposes. Explain if this is the case.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 8: Section B contains two questions about licensing and qualification only for hospitals, nursing homes and special services homes.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 9: Section C concerns the attachments all organizations other than educational institutions must submit.

Florida Ad Valorem Tax Exemption Application And Return DR-504 Step 10: Sign and date the form. Print your title.