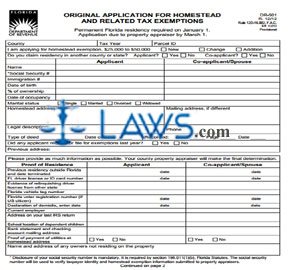

Form DR-501 Originial Application for Homestead and Related Tax Exemptions

INSTRUCTIONS: FLORIDA ORIGINAL APPLICATION FOR HOMESTEAD AND RELATED TAX EXEMPTIONS (Form DR-501)

Every Florida resident who lives on a property they own on a permanent basis on the state is eligible for a property tax exemption of up to $50,000. Those 65 and older, widows and widowers, the blind and disabled are also eligible for additional exemptions. To apply, you must complete form DR-501 and submit it to your county's property appraiser by March 1.

Florida Original Application For Homestead And Related Tax Exemptions DR-501 Step 1: At the top of the form, indicate with a check mark whether this is a new application, one documenting a change in your property, or one documenting an addition to your property. Enter the county name and tax year.

Florida Original Application For Homestead And Related Tax Exemptions DR-501 Step 2: Give your name, Social Security or immigration number, date of birth, the percent of ownership you have in the property and marital status. If submitting with another co-owner, they must provide the same information.

Florida Original Application For Homestead And Related Tax Exemptions DR-501 Step 3: Give the homestead address, its parcel identification number or a legal description, the type of deed and date it was recorded and its book number, page and date in county records. Note whether either applicant filed for exemptions the previous year.

Florida Original Application For Homestead And Related Tax Exemptions DR-501 Step 4: On the right, indicate all exemptions you are seeking. In addition to checking the box next to "Homestead Exemption, $25,000 to $50,000," check the box next to any statements about your status that qualify you for additional benefits as described on page two of the application.

Florida Original Application For Homestead And Related Tax Exemptions DR-501 Step 5: The next table concerns proof of residence for both you and your co-applicant, if any. Indicate with a check mark whether you own any other property in another state.

Florida Original Application For Homestead And Related Tax Exemptions DR-501 Step 6: Give the location of your last previous residency outside Florida and the date on which it terminated, your driver license or identification card number, evidence of having relinquished a driver's license from another state and all other information requested about your location and finances. Sign and date the form.