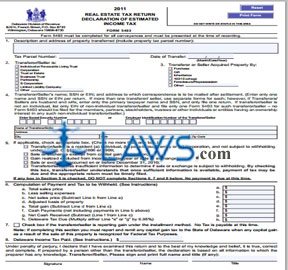

Form 5403 Real Estate Tax Return Declaration of Estimated Income Tax

INSTRUCTIONS: DELAWARE REAL ESTATE TAX RETURN DECLARATION OF ESTIMATED INCOME TAX (Form 5403)

Every non-resident and business which completes a real estate transaction in Delaware must pay a state real estate tax of 6.95%. The seller must complete and submit a form 5403 and present it when the deed transfer or other transaction is formally recorded. The form is on the website of the Delaware Division of Revenue.

Delaware Real Estate Tax Return Declaration Of Estimated Income Tax 5403 Step 1: Section 1 asks for a description and the address of the property, including the property tax parcel number assigned.

Delaware Real Estate Tax Return Declaration Of Estimated Income Tax 5403 Step 2: Section 2 asks whether the person selling or transferring the property is an individual or revocable living trust, corporation, trust or estate, business trust, partnership, S Corporation or LLC. If none of the above, explain. Section 3 asks whether the transaction was a purchase, gift, inheritance, 1031 exchange, foreclosure/repossesion or other. If the latter, explain.

Delaware Real Estate Tax Return Declaration Of Estimated Income Tax 5403 Step 3: Section 4 asks for the name and Social Security or employer identification number of the seller, as well as the address to which correspondence should be sent. In section 5, check the box to no more than one box whose statement applies to your transaction.

Delaware Real Estate Tax Return Declaration Of Estimated Income Tax 5403 Step 4: Real estate tax owed is computed in section 6. On line 6a, enter the total sales price. On line 6b, enter the selling expenses. Subtract line 6b from 6a to determine your net sales price on line 6c.

Delaware Real Estate Tax Return Declaration Of Estimated Income Tax 5403 Step 5: On line 6d, enter costs such as mortgages and improvements. Subtract this from line 6c to determine total gain on line 6e. If you received any cash payments, note them on line 6f, then subtract this from line 6c. Depending on which applies, multiple line 6e or 6g by 6.95% to determine Delaware tax due on line 6h.

Delaware Real Estate Tax Return Declaration Of Estimated Income Tax 5403 Step 6: Check the box in section 7 if the seller is reporting gain using the installment method. Enter the amount of payment being submitted in section 8. Sign and date the form and give your title.