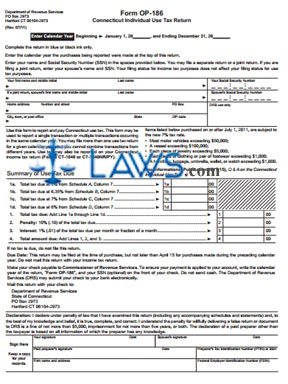

Form OP-186 Individual Use Tax Return

INSTRUCTIONS: CONNECTICUT INDIVIDUAL USE TAX RETURN (Form OP-186)

Connecticut residents must complete a form OP-186 to pay use tax on any tangible personal property purchased on which no state sales tax was paid. This document is found on the website of the Connecticut government.

Connecticut Individual Use Tax Return OP-186 Step 1: At the top of the page, enter the date of the year for which you are filing.

Connecticut Individual Use Tax Return OP-186 Step 2: In the first section, give your name, address and Social Security number. If you file taxes jointly with a spouse, provide their Social Security number as.

Connecticut Individual Use Tax Return OP-186 Step 3: Skip to the second page. In the section labeled "Section A," provide information about all applicable purchases of computer and data processing services. Give the date of purchase, a description of the services, the name of the retailer or service provider and the purchase price in the first four columns. The tax rate for such purchases is 1%. Multiply the price by this rate and enter the result in the fifth column. Enter taxes already paid in the sixth column and subtract this from the fifth column to determine total tax due. Add the total balance of these taxes and transfer it to line 1a.

Connecticut Individual Use Tax Return OP-186 Step 4: Schedule B is for the computation of sales tax on nearly all items except those listed in Step 5. These items are taxed at a rate of 6.35%. Provide all information requested, calculate the tax owed, and transfer this total to line 1b.

Connecticut Individual Use Tax Return OP-186 Step 5: Schedule C is for the computation of sales tax on motor vehicles for which more than $50,000 was paid, vessels which cost more than $100,000, jewelry which cost more than $5,000, anc clothing and shoes which cost more than $1,000. These items are taxed at a 7% rate. Perform all calculations as directed and transfer the total to line 1c.

Connecticut Individual Use Tax Return OP-186 Step 6: Schedule D concerns purchases made before June 30, 2011, which are taxed at 6%. Transfer this total to line 1d.

Connecticut Individual Use Tax Return OP-186 Step 7: On the return, add lines 1a through 1d to determine your total due. If filing late, calculate your penalty and interest as directed.