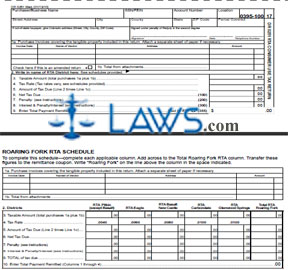

Form DR-0251 RTA Consumer Use Tax Return

INSTRUCTIONS: COLORADO RTA CONSUMER USE TAX RETURN (Form DR 0251)

Colorado consumers and businesses who are in one of the state's four Rural Transportation Authority (RTA) districts (Roaring Forks, Pikes Peak, Baptist Road and South Platte Valley) and who purchased items without paying sales tax in or out of the state must file an annual form DR 0251. The form must be filed with the Colorado Department of Revenue and is available on the state's website.

Colorado RTA Consumer Use Tax Return DR 0251 Step 1: Detach the bottom part of the third page and complete the coupon below. The top of this section asks for your business name or that of a purchaser, as well as address and identification information. The purchaser or business owner must sign and date the form.

Colorado RTA Consumer Use Tax Return DR 0251 Step 2: Line 1a requires you to list invoices for all tangible personal property detailed in the return. Include the invoice number, the name of the vendor, their address and the amount paid. If including attachment sheets for additional property, include their total on line 1b.

Colorado RTA Consumer Use Tax Return DR 0251 Step 3: Write the name of the district on line 2. Total lines 1a and 1b and enter the amount on line 3.

Colorado RTA Consumer Use Tax Return DR 0251 Step 4: Skip down to the next page. You must complete the schedule applicable to your district, since different taxation rates are set. Regardless of the schedule you complete, you will be entering the same information.

Colorado RTA Consumer Use Tax Return DR 0251 Step 5: Regardless of which schedule you are completing, you must again detail your invoices and then multiply the total by the rate set by their district. Complete all computations as instructed to determine your tax due.

Colorado RTA Consumer Use Tax Return DR 0251 Step 6: Return to the coupon. Enter your district's tax rate on line 4. Multiply this by line 3 to determine your tax due and complete the coupon as instructed.

Colorado RTA Consumer Use Tax Return DR 0251 Step 7: Individual consumers must file this form by April 15th. Businesses must file this form by the 20th of the month following the date on which they accumulate $300 or more in unpaid use taxes.