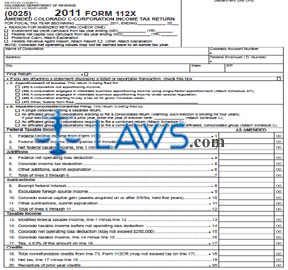

Form 112X Amended Colorado C-Corporation Income Tax Return

INSTRUCTIONS: AMENDED COLORADO C-CORPORATION INCOME TAX RETURN (Form 112-X)

C-Corporations doing business in Colorado may use a form 112-X to amend an initially filed state income tax return. This form can also be completed online. Whether completing the paper or electronic forms, both are available on the website of the state government of Colorado.

Amended Colorado C-Corporation Income Tax Return 112-X Step 1: Give your fiscal year beginning and end dates if not filing on a calendar year basis.

Amended Colorado C-Corporation Income Tax Return 112-X Step 2: Check the box next to the applicable reason describing why you are filing an amended return.

Amended Colorado C-Corporation Income Tax Return 112-X Step 3: Enter your corporation name, state account number, federal employer identification number, address, city, state and zip code. Indicate with a check mark whether this is a final return.

Amended Colorado C-Corporation Income Tax Return 112-X Step 4: If attaching a statement reporting a listed or reported transaction, check the box where indicated.

Amended Colorado C-Corporation Income Tax Return 112-X Step 5: Check all applicable boxes in sections A and B regarding apportionment of income and whether you are filing a separate, combined or consolidated return.

Amended Colorado C-Corporation Income Tax Return 112-X Step 6: Document your federal taxable income as instructed on lines 1 through 3.

Amended Colorado C-Corporation Income Tax Return 112-X Step 7: Document your additions as instructed on lines 4 through 7.

Amended Colorado C-Corporation Income Tax Return 112-X Step 8: Document your subtractions as instructed on lines 8 through 12.

Amended Colorado C-Corporation Income Tax Return 112-X Step 9: Calculate your taxable income as instructed on lines 13 through 17.

Amended Colorado C-Corporation Income Tax Return 112-X Step 10: Skip to form 112CR, which begins on the fourth page. Document and calculate your total nonrefundable credits and enter the total on line 73. Transfer this value to line 18 on the first page.

Amended Colorado C-Corporation Income Tax Return 112-X Step 11: Follow the instructions on lines 19 through 25 to adjust your tax based on credits and withheld tax payments. If you are claiming a refundable alternative vehicle fuel credit, this must be documented on both line 24 here and on line 74 of form 112CR.

Amended Colorado C-Corporation Income Tax Return 112-X Step 12: Complete instructions on lines 26 through 41 to compute your final amount owed or refund due.