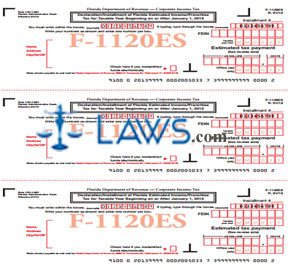

Form F-1120ES Declaration Installment of Florida Estimated Income Franchise Tax

INSTRUCTIONS: DECLARATION/INSTALLMENT OF FLORIDA ESTIMATED INCOME/FRANCHISE TAX (Form F-1120ES)

Corporations operating in Florida which are subtext to state income and franchise tax under the provisions of Chapter 220 of the state's statutes and which owe more than $2,500 in state income tax annually must make estimated tax payments using a form F-1120ES. This document is found on the website of the Florida Department of Revenue. This document can also be filed online rather than through the mail.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 1: The document is a two-sided page containing three copies. One should be mailed to the Department of Revenue, while the other two are maintained for your records. On the reverse side of the form, enter the name of a contact person for questions and their phone number.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 2: In the worksheet on the reverse side of the page, enter the amount of this installment payment on the first line.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 3: On the second line, enter the amount of overpayment from last year being applied as a credit to the estimated tax on this form, if applicable.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 4: Subtract line 2 from line 1. Enter the difference on line 3.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 5: Transfer the value from line 3 to the boxes under "Estimated Tax Payments" on the front side of the document.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 6: At the top right-hand corner of the front page, enter the number of the installment.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 7: Enter your federal employer identification number in the box below.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 8: Enter the month, date and year of the taxable year's end.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 9: On the left, enter your corporation name and address.

Declaration/Installment Of Florida Estimated Income/Franchise Tax F-1120ES Step 10: The form must be filed along with payment before the last day of the 4th, 6th and 9th months of the taxable year, and before the last day of the taxable year.