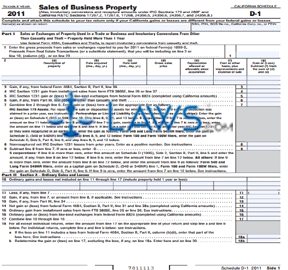

Form Schedule D-1 Sales of Business Property

INSTRUCTIONS: CALIFORNIA SALES OF BUSINESS PROPERTY (Schedule D-1)

California businesses which sell their property during the course of the year must file a schedule D-1 with the state in order to determine the valuation and attendant taxation of the assets. This form should only be completed once you have completed your federal tax returns, as much of the information required will be transferred from these documents. Schedule D-1 is found on the website of California's Franchise Tax Board. Only attach this form with your tax returns if your calculations show your California gains or losses differ from your federal gains or losses.

California Sales Of Business Property D-1 Step 1: Enter your name as shown on your tax return and your identifying number at the top of the first page.

California Sales Of Business Property D-1 Step 2: On line one of Part I, enter the total proceeds from sales and transactions of property held for more than a year which you reported on your federal form 1099-S.

California Schedule D-1 Sales of Business Property Step 3: On line two, give a description of the property, the date of acquisition and sale, the gross sales price, depreciation allowed since your acquisition, cost and improvement and other expenses associated. Subtract the expenses from the sum of the sales price and depreciation to determine your net gain or loss.

California Schedule D-1 Sales of Business Property Step 4: The rest of Part I requires you to provide information from various federal return forms.

California Schedule D-1 Sales of Business Property Step 5: Part II concerns ordinary gains and losses not reportable in Parts I or III of property held for less than one year.

California Schedule D-1 Sales of Business Property Step 6: Part III concerns further calculations involving depreciation in order to determine your total gains and losses with regards to the sale of business property.

California Schedule D-1 Sales of Business Property Step 7: Part IV is for the use of businesses who took a deduction under IRC Section 179 for property placed in service after January 1, 1987, other than listed property. It is also used to make calculations concerning unused property, property which ceased to be qualified within two years of being placed in service, and for businesses who qualify under various state Revenue And Taxation Code (R&TC) exemptions.