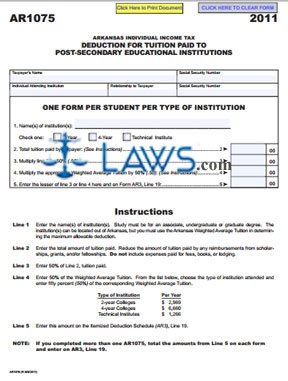

AR1075 Deduction for Tuition Paid to Post-Secondary Educational Institutions

INSTRUCTIONS: ARKANSAS DEDUCTION FOR TUITION PAID TO POST-SECONDARY EDUCATIONAL INSTITUTIONS (Form AR1075)

To obtain an Arkansas tax deduction for tuition paid to a post-secondary education institution, a form AR1075 should be completed. This document can be obtained from the website maintained by the Arizona Department of Finance and Administration.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 1: Enter the taxpayer's name in the first box.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 2: Enter the taxpayer's Social Security number in the second box.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 3: Enter the name of the individual attending the educational institution in the third box.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 4: In the fourth box, enter the relationship of the individual attending the educational institution to the taxpayer.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 5: In the fifth box, enter the Social Security number of the individual attending the educational institution.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 6: On line 1, enter the name of the education institution. Indicate with a check mark whether this is a 2-year program, a 4-year program or a technical institute.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 7: On line 2, enter the total tuition paid by the taxpayer. Do not include expenses incurred when paying for books, lodging or fees as part of this figure.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 8: Multiply line 2 by 50%. Enter the resulting product on line 3.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 9: Multiply the appropriate Weighted Average Tuition (as given in a table in the instructions) by 50%. Enter the resulting product on line 4.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 10: Enter the lesser of line 3 or line 4 on line 5.

Arkansas Deduction For Tuition Paid To Post-Secondary Educational Institutions AR1075 Step 11: Transfer the value from line 5 here to line 19 on form AR3. If you completed multiple forms AR1075, enter the sum total of line 5 from all pages on line 19.