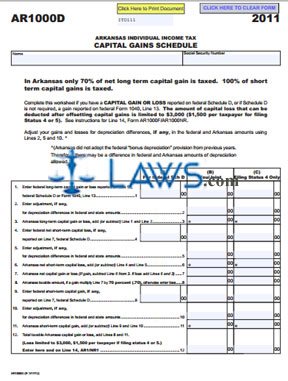

AR1000D Capital Gains Schedule

INSTRUCTIONS: ARKANSAS CAPITAL GAINS SCHEDULE (Form AR1000D)

If you report a capital gain or loss on federal Schedule D, as an Arkansas resident you are required to complete a form 1000D. This document can be obtained from the website maintained by the Arkansas Department of Finance and Administration.

Arkansas Capital Gains Schedule AR1000D Step 1: In the first blank box, enter your name.

Arkansas Capital Gains Schedule AR1000D Step 2: In the second blank box, enter your Social Security number.

Arkansas Capital Gains Schedule AR1000D Step 3: Throughout the form, three columns may need to be filled in. Column A is for figures as reported on Schedule D, column B is for you or joint figures, and column C is for filing status 4 taxpayers only. On line 1, enter your federal long-term capital gain or loss as entered on line 15 of Schedule D or line 13 of federal form 1040.

Arkansas Capital Gains Schedule AR1000D Step 4: On line 2, enter your adjustment for depreciation differences in federal and state amounts, if applicable.

Arkansas Capital Gains Schedule AR1000D Step 5: Subtract line 2 from line 1 or add them as appropriate. Enter the result on line 3.

Arkansas Capital Gains Schedule AR1000D Step 6: On line 4, enter your federal net short-term loss reported on line 7 of Schedule D, if applicable.

Arkansas Capital Gains Schedule AR1000D Step 7: On line 5, enter adjustment for federal and state depreciation differences for line 4, if appropriate.

Arkansas Capital Gains Schedule AR1000D Step 8: Add or subtract lines 4 and 5 as appropriate. Enter the result on line 6.

Arkansas Capital Gains Schedule AR1000D Step 9: On line 7, subtract line 6 from line 3. If this results in a loss, add the two lines instead.

Arkansas Capital Gains Schedule AR1000D Step 10: On line 8, if the result of line 7 is a gain, multiply it by .70. Otherwise, enter the figure of the loss.

Arkansas Capital Gains Schedule AR1000D Step 11: On line 9, enter your federal short-term capital gain reported on line 7 of Schedule D, if applicable.

Arkansas Capital Gains Schedule AR1000D Step 12: On line 10, enter the federal and state depreciation differences for line 9, if applicable.

Arkansas Capital Gains Schedule AR1000D Step 13: Complete lines 11 and 12 as instructed.