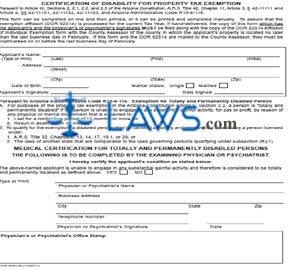

Form Certification of Disability of Property Tax Exemption

INSTRUCTIONS: ARIZONA CERTIFICATION OF DISABILITY FOR PROPERTY TAX EXEMPTION (Form DOR 82514B)

Arizona residents who are completely physically or mentally disabled must must obtain a certification of their status from a physician or psychiatrist in order to qualify for a property tax exemption related to their disability. This document must be filed along must filed alongside your affidavit of individual exemption (form 82514). The document can be completed online and printed or completed by hand.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 1: On the first line, enter the full name of the applicant.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 2: On the second and third lines, enter their street address, city, state and zip code.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 3: On the fourth line, give the applicant's date of birth and indicate with a check mark whether they are single or married.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 4: On the next line, the applicant should sign and date the form.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 5: The bottom half of the form should by completed by your psychiatrist or physician.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 6: On the first line of this section, the medical professional should indicate with a check mark whether your disability is expected to be total and permanent.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 7: On the next line of this section, the medical professional should indicate with a check mark if this disability makes it impossible for the applicant to engage in any substantial gainful activity.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 8: The physician or psychiatrist should enter their name, business address, telephone number, signature and date.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 9: The office of the psychiatrist or physician should provide their stamp on the bottom of the form.

Arizona Certification Of Disability For Property Tax Exemption DOR 82514B Step 10: File this form along with your DOR 82514 with the county assessor in your area no later than the last business day of February.